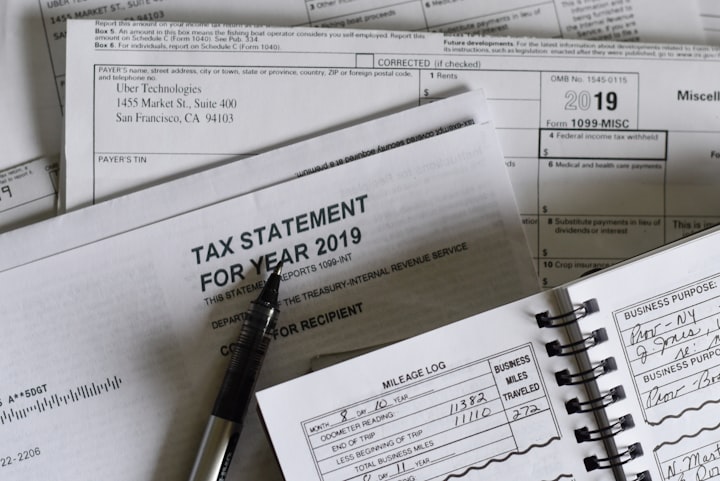

Taxes On Selling Feet Pics: A Guide For Paying Taxes When Selling Feet Pics

If you are making over $600 a year on selling Feet Pics, then you, as an American citizen, have to pay taxes. Here in this article, we help you understand everything about selling Feet pics in relation to taxes.

Taxes On Feet Pics: I’m thinking about selling feet pictures for extra cash online, will I need to file taxes for the money I make?

Marketing feet pics online has spawned a huge industry. Many individuals earn thousands of dollars every month just by taking some cool feet pics in multi-colored backgrounds with their feet studded with all sorts of weird accessories. Selling feet pics seems like a simple task, especially once you've found a fan base and have begun marketing.

No doubt, it takes time and effort to really get into the flow because there’s such a huge community of ingenious content makers out there. Why would the buyers want to opt for a complete novice than these veterans? This is the reason many people don’t even get a chance.

Regardless, if you’re one of the lucky ones that start selling and make a name for themselves, by now, you must be raking it in. You may be thinking that selling feet pics is just a side hustle, but the truth is, once you’re making substantial amounts of money through this trade, you have to file taxes on feet pics.

This might even sound absurd that you have to file taxes on something you’re only doing as a hobby. But the fact is, in cases of considerably large amounts of earnings, your side hustle is no longer a hobby. It is counted as a business with you being the lone proprietor.

And of course, if it's business, then by all means, you must pay taxes on it.

To go into the details of things, the ensuing read will provide answers to all your queries when you are filing taxes on feet pics.

Do I Have to Pay Taxes on Feet Pics?

Of course, not everyone who is marketing feet pics earns enough to qualify as a taxpayer on feet pics. According to regulation, US nationals who earn over $600 within a calendar year are liable to pay taxes on their business. Most feet pics sellers earn this much easily within two months let alone a whole calendar year. If you are one of those, then yes, you do have to pay taxes on feet pics.

If you are working online, then chances are, you’ll be notified when it's time for you to file taxes on feet pics. Numerous online platforms dispatch you a prompt when you are assumed to file taxes on feet pics. It’s really a matter of where you’re working though, and it's still better to memorize these things yourself.

If you are one of the ones that make more than $600 while marketing feet pics, you should confer with an accountant to get the details of how much taxes on feet pics you are entitled to pay. The expenses you spend on your gear are also taken into account and in some cases, you might earn a refund.

To begin with, the gear you use for work, which could be your accessories, internet connection, camera, listing cost, etc. all count as deductions. On that basis, you’ll have to keep a fair record of the goods that you are utilizing while marketing your feet pics. When you consult the accountant at filing time, he will ask for these details to determine how much taxes on feet pics you are to pay.

Where to sell Feet pics: FeetFinder and Taxes:

FeetFinder is the best site for anyone looking to sell their Feet pictures and videos. On FeetFinder, you can make money by getting paying subscribers, selling Feet albums, and making money through receiving a Tip from your fans.

Your fans can pay a Tip to you and order custom content from you on FeetFinder. If you are selling Feet pics and videos on one platform like FeetFinder, you can easily calculate your taxes and it will be way easy for you to report taxes.

Is it Legal to Sell Feet Pics?

Absolutely. You don’t need to have any reservations when selling feet pics online. Although at times, it seems that it is easy to consider this trade closely linked with pornograpy, at least in the way it is portrayed. This makes you wonder if it is okay for you to sell feet pics online, or if you are in for a ban from social media sites. However, that is not the case.

This can be best explained by the fact that not all the consumers that come to buy your feet pics have a foot fixation that they want to gratify by looking at some arousing feet pics. All sorts of people need feet pics for all sorts of reasons such as stock photo websites, advertising agencies, medical researchers, shoe manufacturers, etc.

Now that you know that selling feet pics is legal, you should consider all the other implications that come with it. You can’t ignore filing for taxes on feet pics if you are making enough dough off of it. Don’t try to conceal your income either, as it will only add to your problems.

How Can I File Taxes on Feet Pics?

With that settled, let us look at the details of how one can file taxes on feet pics.

Step 1: Filing Taxes as Business Income

To start off, you will need to file your extra earnings from selling feet pics on Schedule C (business income) along with your business expenditure which includes supplies and bills, etc. Schedule C (you can file this electronically with Form 1040) is used to declare any payment or loss from a business that you are running which could be something like single-member LLCs, or a trade that you are practicing as a lone proprietor.

Remember that if your primary reason for engaging in a particular activity is to earn revenue or profit, then that activity is deemed a business. To add to that, if you are doing this activity on a continuous and regular basis, that also comes under the definition of a business.

Step 2: Filing for Self-employment Tax

After declaring your income as business income, comes the second step of declaring yourself self-employed. You can do this by carrying the returns or loss of your business over to schedule SE (which is used to compute self-employment tax). Self-employed people, such as freelancers, remote business contractors, or in your case, feet pics sellers, are typically needed to pay self-employment (SE) tax as well as income tax.

This tax is basically for those who work for themselves and is analogous to the Social Security and Medicare taxes which are deducted from the pay of most wage earners. Basically, the self-employment tax is a blend of the employer and employee share of FICA, which is a U.S. nationwide payroll tax, and applies to net profits from self-employment tax.

Step 3: Filling the Form 1040

The next step you need to take when you file taxes on feet pics, is heading over to Form 1040. The IRS 1040 form is one of the authorized documents that are used by U.S. taxpayers when they are filing for their yearly income tax returns. This form is separated into sections where you are needed to document your income and deductions to decide the amount of tax you’ll be required to pay or the refund you can expect to acquire after you've filed for it.

Tip: Keep Accurate Records of Your Expenditure

In order to avoid any inconsistency when filing taxes on feet pics, you should always preserve a precise record of all your expenditures. Any earnings that you make from your side hustle of marketing feet pics will be counted up with your regular income to estimate your income tax. Your self-employment tax also gets added to that calculation.

What this means is that you must have exact records of not just your income but your business expenditures as well, as you wouldn’t want to file for those taxes on feet pics that went towards your expenses.

Keep in mind, as this is business income, there isn’t any inferior threshold when you are required to file taxes, unlike there is with a straightforward W2 employee. W2 tax is applicable if you are working for a company. The payroll taxes of employees who acquire a W2 form are withheld throughout the year and they get their pay through their employer's payroll.

What If I Don’t File Taxes on Feet Pics?

If you think that not filing taxes on feet pics isn’t that big a deal, the reality might be a punch to the gut for you.

If you are expected to file taxes but pick not to do so, the IRS has several unpleasant ways for bringing you to the table. Some of these measures include but are not limited to, levying penalties, charging fines and interest, implementing tax liens, or more harsh measures, such as incarceration, on charges of avoiding any excessive taxes that you are supposed to pay.

If you do not timely file taxes on feet pics, you may end up with what’s called a Failure to File Penalty. This punishment for failing to file symbolizes 5% of the liability for your unpaid taxes for each month that your return was delayed, and it can go up to 25% of your entire unpaid taxes.

Although if you are expecting a refund, there’s no punishment for failure to file taxes on feet pics. But don’t expect to receive that refund anymore.

How To Get Caught for Not Filing Taxes?

It takes little effort on your part to get into trouble for not filing taxes on feet pics. Most online platforms where you can market feet pics use several online payment methods such as PayPal, Venmo, crypto, etc. Of course, you can always use your bank account to accept payments, but it is seldom advised to do so.

These money transfers, whether through an online payment method or your bank account, are easily obtainable by the IRS. They can find out whenever you complete transactions or accept something. If you choose to not pay taxes on feet pics when you should, the IRS may perform an audit which could lead toward you being indicted for not filing and paying taxes on feet pics.

How to Reduce Taxes on Feet Pics?

If you'd rather not have to pay huge amounts of taxes to the IRS, you can adopt a number of strategies to do so. But don't forget that you can't be completely exempt from paying taxes. If you try any funny business with the IRS, you'll only be bringing a lot of trouble on your own head. So keep a rational head about you and don't miss deadlines. Here are a couple of ways you can reduce the amount of taxes on feet pics.

Deducting Business Expenses

You can deduct miscellaneous business expenditures from your taxable earnings when you file taxes on feet pics. These deductions comprise of internet or electricity bills, accompaniments or foot products you needed to purchase, or anything that was utilized to help with your work. You should keep proper evidence of expenses just in case you are requested to display it.

The SE Tax Deduction Scheme

This strategy will help you lower your taxes considerably. Since as a feet pic dealer, you are a solitary proprietor, you can declare the self-employment tax deduction on Schedule SE in your Form 1040 when you file your taxes on feet pics.

When you do so, document your self-employed returns in the “Other Taxes” section, which helps ensure that the IRS will take notice, and as is appropriate, distinguish the self-employed tax from the federal income tax. You can save a lot of your gains while paying taxes on feet pics by adopting this method.

A Health Savings Account (HSA)

A Health Savings Account, or HSA, is a tax-advantaged account used to disburse qualifying medical fees as well as insurance premiums.

Adding to an HSA must be done with pre-taxed earnings, which means your taxable income is lessened. Moreover, if you use the funds in your account to pay for qualifying medical costs, the withdrawals carry no tax.

Taxes On Feet Pics: Why You Should Pay Them?

To put things simply, if you have no other source of earnings and marketing feet pics is how you make your livelihood, you are required to file your taxes on feet pics. Do not forget that self-employment taxes begin at a low threshold of $600, and the initial rate is 15.3% (the aggregate of rates for Social Security and Medicare, which are 12.4% and 2.9%, respectively).

Even if selling feet pics is just your hobby, you may qualify for filing taxes on feet pics. You’ll need to get a professional to direct you through it. If you want to bypass paying too much taxes on feet pics, you can adopt multiple different strategies. As long as you do it right, tax avoidance is lawful. But falsifying your expenditure documents or contributions will end up with you facing prosecution.

About the Creator

A

I write my heart out here. My posts are informational and something I do great research for SEO before writing it. Follow me on Twitter: Aamir Twitter,

Comments

There are no comments for this story

Be the first to respond and start the conversation.