FINANCIAL CONSTRAINTS IN THE WORLD

Macroeconomic Constraints: Causes and solutions to the problem.

Macroeconomic constraints refer to the challenges and limitations that arise at the aggregate level of an economy, impacting its overall performance and stability. These constraints can have far-reaching consequences for individuals, businesses, and governments. Understanding the causes of macroeconomic constraints is crucial for implementing effective solutions. Here, we will explore some common causes and potential solutions to address these challenges.

Causes of Macroeconomic Constraints:

1. Economic Recession

A recession occurs when there is a significant decline in economic activity, typically characterized by a contraction in GDP, rising unemployment rates, and decreased consumer spending. Causes of recessions can vary, but common factors include a decline in business investment, reduced consumer confidence, financial crises, or external shocks like natural disasters or pandemics.

2. Inflation

Inflation is the sustained increase in the general price level of goods and services in an economy over time. Several factors contribute to inflation, including excessive money supply growth, increased production costs, high demand, or supply shocks. Inflation erodes purchasing power, reduces consumer and investor confidence, and distorts economic decision-making.

3. Currency Depreciation

Currency depreciation occurs when a country's currency loses value relative to other currencies. It can result from factors such as trade imbalances, capital outflows, changes in interest rates, or market speculation. Currency depreciation affects imports, making them more expensive and potentially leading to higher inflation rates.

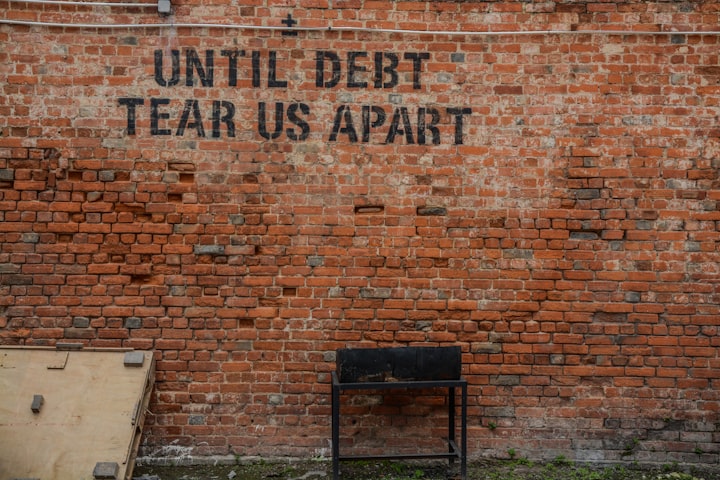

4. Government Debt and Fiscal Constraints

High levels of government debt and fiscal deficits can strain an economy. Governments may accumulate debt due to excessive spending, economic downturns, or inadequate revenue generation. The burden of debt and fiscal constraints limits the government's ability to invest in infrastructure, education, healthcare, and social programs, impacting long-term growth prospects.

Solutions to Macroeconomic Constraints:

1. Monetary Policy

Central banks can implement monetary policy tools to address macroeconomic constraints. By adjusting interest rates, open market operations, or reserve requirements, central banks can influence borrowing costs, money supply, and inflation rates. Effective monetary policy can help stabilize an economy, stimulate investment, and manage inflationary pressures.

2. Fiscal Policy

Governments can employ fiscal policy measures to tackle macroeconomic constraints. These policies involve adjusting government spending and taxation to influence aggregate demand and stabilize the economy. During a recession, expansionary fiscal policies such as increased government spending or tax cuts can stimulate economic activity. Conversely, during periods of high inflation, contractionary fiscal policies like reducing government expenditure or increasing taxes can help curb inflationary pressures.

3. Structural Reforms

Structural reforms aim to improve the long-term performance and resilience of an economy. These reforms may include deregulation, trade liberalization, labor market reforms, and investment in infrastructure. By enhancing competition, encouraging innovation, and improving productivity, structural reforms can boost economic growth, create employment opportunities, and reduce macroeconomic constraints.

4. Exchange Rate Policies

Governments can adopt appropriate exchange rate policies to address currency depreciation. In some cases, they may intervene in the foreign exchange market to stabilize the currency or implement policies that promote export competitiveness. Flexible exchange rate regimes allow for market-driven adjustments, while fixed exchange rate regimes provide stability but require careful management.

5. Investment in Human Capital

Enhancing education and skill development programs can contribute to long-term economic growth and reduce macroeconomic constraints. By investing in human capital, governments and businesses can foster innovation, productivity, and entrepreneurship, leading to higher employment rates and improved economic performance.

6. Financial Sector Reforms

Strengthening the financial sector through regulatory reforms and improved supervision can enhance stability and mitigate macroeconomic constraints. Measures such as enhancing risk management practices, promoting transparency, and addressing systemic vulnerabilities can help prevent financial crises and promote sustainable economic growth.

7. International Cooperation

Addressing macroeconomic constraints often requires international cooperation and coordination. Countries can work together to promote fair trade practices, resolve global imbalances, and collaborate on addressing common challenges such as climate change or pandemics. International organizations like the International Monetary Fund (IMF) play a vital role in providing financial assistance, policy advice, and facilitating global cooperation.

About the Creator

FRIDAH WANJIKU

Hello esteemed, I am grateful to let you know I am always interested updating my readers on what is trending generaly in the world. It is my pleasure to know that you are enlightened about whatever is happening and how to deal with it.

Comments

There are no comments for this story

Be the first to respond and start the conversation.