.Investing in the Stock Market: Why Now is the Right Time

Are you looking for a way to grow your wealth and secure your financial future? Investing in the stock market is one of the most popular and effective ways to do just that. With the current economic climate being favorable for investing, now is the perfect time to take the leap and start investing in stocks.

Why Invest in the Stock Market?

Investing in the stock market is a great way to build wealth over the long term. When you buy stocks, you own a small piece of the company and have the potential to earn money through dividends and capital appreciation. Historically, the stock market has produced higher returns than other investments, such as bonds or savings accounts.

Benefits of Investing in Stocks

Potential for High Returns: Investing in the stock market has the potential to generate higher returns than other investments.

Diversification: By investing in a variety of stocks, you can diversify your portfolio and reduce your risk.

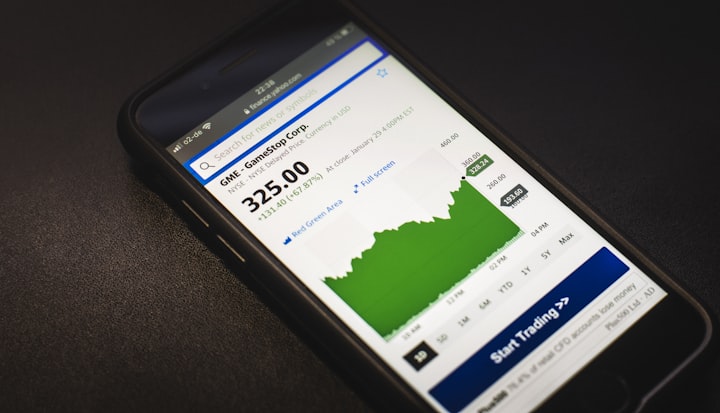

Convenient and Accessible: Thanks to the advancement of technology, it's easier than ever to invest in stocks. You can open a brokerage account online and start investing with just a few clicks.

Why Invest Now?

Low Interest Rates: With interest rates at historic lows, investing in the stock market is more attractive than keeping your money in a savings account.

Strong Economic Recovery: The global economy is recovering from the pandemic, and stock prices are reflecting this positive outlook.

Increased Consumer Spending: As the world emerges from the pandemic, consumer spending is expected to increase, leading to a boost in the stock market.

How to Start Investing in Stocks

Educate Yourself: Before you start investing in stocks, it's important to educate yourself about the stock market and the different types of investments available.

Open a Brokerage Account: You'll need to open a brokerage account to start investing in stocks. Look for a brokerage that offers low fees and a wide range of investment options.

Set a Budget: Determine how much money you can afford to invest and stick to your budget.

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your portfolio by investing in a variety of stocks from different industries and market sectors.

Consider Working with a Financial Advisor: If you're new to investing or unsure about where to start, consider working with a financial advisor. A financial advisor can help you create a personalized investment strategy based on your financial goals and risk tolerance.

Start Small: Don't try to make a big splash in the stock market right away. Start small and gradually increase your investment as you become more comfortable and knowledgeable about the stock market.

Keep Your Emotions in Check: It's important to keep your emotions in check when investing in stocks. Don't make impulsive decisions based on short-term market fluctuations. Instead, stick to your investment strategy and focus on the long-term potential of your investments.

Stay Informed: Stay informed about the companies you're investing in and the stock market as a whole. Read financial news and follow market trends to help you make informed investment decisions.

Review Your Portfolio Regularly: Review your portfolio regularly to ensure that your investments are aligned with your financial goals and risk tolerance. Consider rebalancing your portfolio if necessary to maintain a diversified mix of stocks.

Don't Put All Your Eggs in One Basket: Diversification is key when investing in the stock market. Don't put all your money into one company or one market sector. Instead, spread your investments across multiple companies and sectors to reduce your risk.

Don't Time the Market: It's impossible to predict the stock market's movements with 100% accuracy. Don't try to time the market by buying and selling stocks based on short-term market trends. Instead, focus on building a diversified portfolio of long-term investments.

Invest in Companies You Know: Invest in companies that you're familiar with and that you believe in. This will help you make informed investment decisions and increase your confidence in the stock market.

Consider Index Funds: Index funds are a type of mutual fund that track a stock market index, such as the S&P 500. They provide broad market exposure and are a low-cost way to invest in the stock market.

Don't Chase High-Flying Stocks: It's tempting to invest in high-flying stocks that are generating a lot of buzz, but these stocks are often overvalued and can be risky investments. Instead, focus on well-established companies with a history of stability and growth.

Be Prepared for Volatility: The stock market can be volatile, and stock prices can fluctuate rapidly. Be prepared for these ups and downs and don't make investment decisions based on short-term market movements.

In conclusion, investing in the stock market is a great way to grow your wealth over the long-term. However, it's important to educate yourself, stay informed, and make informed investment decisions. By following these tips, you can maximize your returns and achieve your financial goals. Remember to start small, diversify your portfolio, and focus on the long-term potential of your investments. With discipline, patience, and a solid investment strategy, you can become a successful stock market investor.

Comments

There are no comments for this story

Be the first to respond and start the conversation.