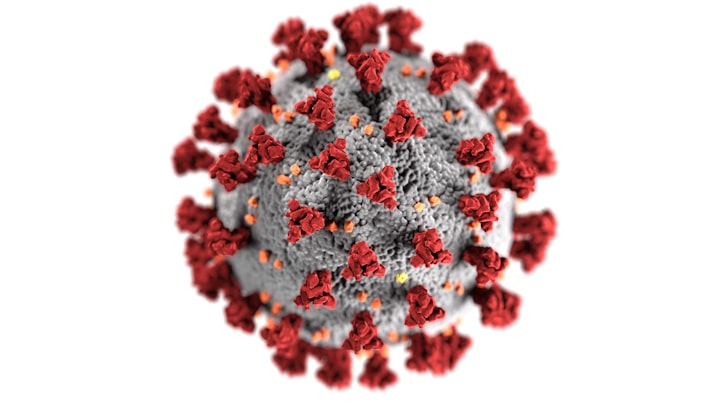

Will Fintechs be wiped out by Coronavirus?

The pandemic is disrupting lives and economies around the world. Fintech was born out of the last crisis, will this one wipe out the industry?

The Coronavirus outbreak is disrupting lives across the world and is having a significant impact on the global economy. The damages are expected to be long-lasting and the recovery very slow, most likely over a number of years. It could accelerate the death of cash as a form of payment. By some accounts, it could be the worst economic crisis in 300 years. This would mean a much bigger impact on businesses around the globe than the Great Financial Crisis or even World War II. Fintech was born out of the last economic crisis, but how is this crisis going to impact the industry? Will fintechs wiped out by Coronavirus or will it come out stronger?

This is nothing new though: like in any crisis, there will be winners and there will be losers (Margin Call is by the way an amazing Wall Street movie about that). Don’t expect this crisis to be any different. What is true for the wider economy is very true for the Fintech industry. The impact will be, overall, very negative.

For instance, similar to many businesses, productivity is down due to the forced remote working. However, let's not panic. Fintechs will not be wiped out by Coronavirus: some businesses should do better than others.

The first losers

Overall, the first losers will be the fintechs that do not have sustainable business models. Startups that are not yet profitable with no clear path to monetization will find it hard to raise more money in that environment. Funds in the form of equity from Venture Capital firms or business loans from banks will be hard to get by. The same banks that are overwhelmed with demands for government-backed schemes like the Paycheck Protection Program (PPP) in the USA.

That seems fair, you tend to be more risk-averse when business failures are likely to rise (and they will be). Or these unprofitable startups with shaky business models will be able to raise equity, but at knock-off valuations. It happened to British neobank Monzo that saw its valuation drop by 40% in its latest funding round. Despite the neobank being a relatively successful business in the UK, it is a very tough environment to raise new funds.

The other likely losers

This economic crisis will hit some segments of the fintech industry particularly hard.

First and foremost, startup lenders will be seriously affected. Particularly lenders focused on consumer and business lending. Low interest rate environments, close to zero in most cases around the world, are not good news for lenders. It usually means very slim net interest margins. That is, the interest margin you make on top of what it costs you to get funded. It will be the same for digital banks that have started to lend after an initial period gathering deposits. Profitability will be further weaken by the fact that personal loans and lending to small businesses will be more impacted than lower risk lending, like residential mortgages.

Many of these new lenders have not been through a full credit cycle as well. And understanding a market cycle is very important in banking. Interest rates have been low for quite some time, so lower net interest margins should not be too troubling. But what happens when loan growth drops significantly and delinquencies increase?

These startup lenders have been used to a benign credit environment and low credit impairments. It is unclear how they will fare in such a stressed business climate.

Natural bias for personal aversion to risk when things are likely to go bad…

People will be less able and willing to invest money for the long term, which will affect companies such as robo-advisors. More generally, customers will avoid to stray away from incumbents and try out new fintech services. For instance, switching your current account to a digital bank like Revolut. If money is scarce and you are trying to save, you probably would prefer to have your cash in a big, well-capitalized bank rather than a startup. This seemingly rational behavior is unfair. But did we say that customers were any rational?

Financial protection schemes protect customer funds in most cases. Schemes like the Financial Services Compensation Scheme (FSCS) or the Federal Deposit Insurance Corporation (FDIC). However, customers tend to be more emotional than rational during an economic crisis.

The possible winners

On the other hand, some fintech businesses should thrive during this crisis. Trading apps such as US-based Robinhood have seen a huge uptick in activity due to the extreme volatility in the financial markets. Market uncertainty typically leads to a rise in trading volume, which often means huge sell-off.

It actually led Robinhood to have serious outages several times over the past few months under the pressure. These trading apps had already seen a big inflow of new customers before the crisis. Millenials or Gen Z first time investors attracted by these new free trading accounts. Even more tempted to try out these new services in a world that gives you 0.5% interest on your savings account.

Payments volume and value will be overall decreasing but some companies should still benefit. Digital payments could increase in a contact-averse world, it a move that could very much accelerate the death of cash. As many countries are under restrictions, people turned to ordering online. This has benefited massively payment enabler companies like Stripe. Countries lifted up limits on contactless payments, which increased volumes drastically. These trends started well before the crisis and are likely to step up.

What next for fintechs?

This economic crisis like the ones before will be a serious test for the industry as a whole, and many businesses will not go through. But the ones that do, especially in the segments that are under a lot of stress like lending, will come out very strong.

We can anticipate the same that happened during the dot-com bubble: many businesses will fail, but the ones that emerge on the other end of the tunnel will take it all…

Fintech Review

About the Creator

Fintech Review

Insight, analysis and news about Fintech topics

Comments

There are no comments for this story

Be the first to respond and start the conversation.