Tax-Saving Strategies Every Entrepreneur Should Know

Managing your taxes effectively can make a significant difference in your bottom line.

As an entrepreneur, managing your taxes effectively can make a significant difference in your bottom line. By understanding and implementing tax-saving strategies, you can maximize your savings and keep more money in your business. In this article, we will explore essential tax-saving tips that every entrepreneur should know. From deductible expenses to advantageous tax structures, these strategies will not only save you money but also ensure you remain compliant with the tax laws. Let's dive in and discover how you can optimize your tax situation for maximum benefit.

Take Advantage of Business Deductions

One of the most powerful ways to reduce your taxable income is by identifying and claiming all eligible business deductions. Keep track of your expenses, including office supplies, travel costs, marketing expenses, and professional services. By deducting these legitimate business expenses, you can lower your taxable income and ultimately reduce your tax liability.

Utilize Home Office Deductions

If you operate your business from a home office, you may qualify for the home office deduction. Calculate the portion of your home that is used exclusively for business purposes and deduct a portion of your mortgage or rent, utilities, and maintenance expenses. This deduction can provide substantial tax savings, so be sure to consult with a tax professional to determine your eligibility.

Consider Incorporating or Forming an LLC

Structuring your business as a corporation or limited liability company (LLC) can offer significant tax advantages. These entities often have lower tax rates, and you may have more flexibility in managing your income and expenses. Consult with an attorney or tax advisor to determine the most suitable business structure for your specific needs and goals.

Understand Self-Employment Taxes

As an entrepreneur, you're responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. However, there are strategies to help reduce these taxes. For instance, you can set up a retirement plan, such as a Simplified Employee Pension (SEP) or a Solo 401(k), to lower your taxable income and save for retirement simultaneously.

Maximize Retirement Contributions

Contributing to retirement accounts not only helps secure your financial future but also provides immediate tax benefits. Take advantage of tax-advantaged retirement plans, such as a SEP IRA or Solo 401(k), and maximize your contributions. By doing so, you can lower your taxable income and defer taxes on the investment earnings until withdrawal during retirement.

Explore Research and Development (R&D) Tax Credits

If your business invests in research and development activities, you may qualify for R&D tax credits. These credits can offset a portion of your tax liability and provide a valuable incentive for innovation. Consult with a tax professional to determine if your business activities qualify for this tax-saving opportunity.

Timing Is Key: Understand Tax Planning Strategies

Timing plays a crucial role in tax planning. Consider the timing of income and expenses to optimize your tax situation. For instance, if you anticipate higher income in the upcoming year, consider delaying billing clients or accelerating deductible expenses into the current year to reduce your taxable income.

Stay Abreast of Tax Law Changes

Tax laws are constantly evolving, and staying informed is essential for maximizing tax savings. Keep up with the latest changes and updates to identify new deductions, credits, or incentives that may benefit your business. Subscribing to reliable tax resources, attending seminars, or consulting with a tax professional can help you navigate these changes effectively.

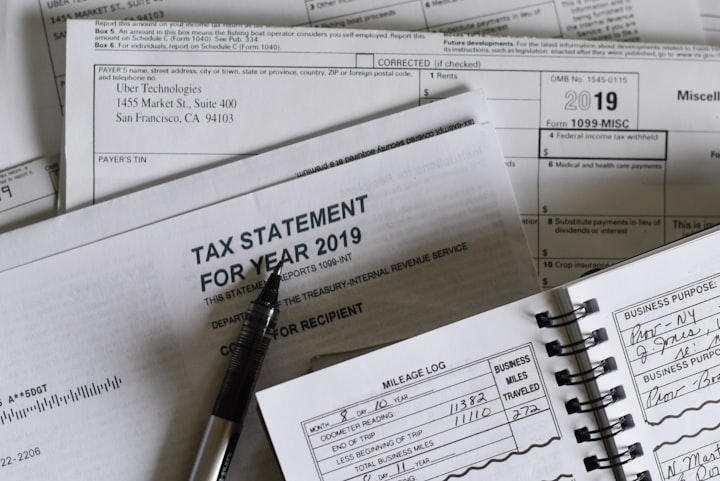

Keep Meticulous Records

Maintaining accurate and organized records is vital for maximizing tax savings. Keep detailed records of income, expenses, receipts, and any other relevant financial documents. Not only will this ensure compliance with tax laws, but it will also make the tax-filing process smoother and fulfilling.

Comments

There are no comments for this story

Be the first to respond and start the conversation.