NYDIG Executive Claims Observers Are Overly Pessimistic About Crypto Industry Regulation

A brief discussion

Summary:

Avoiding sweeping statements in digital asset industry analysis.

Macro factors could still play a vital role, despite declining correlations.

What does historical data suggest for March market trends?

Part 1. The digital asset industry is more intricate than is typically thought.

Amid the regulatory activities and changes that support the digital asset industry service providers, we have noticed that more and more industry experts are making general claims about these events without carefully reading or properly understanding the relevant background to conduct in-depth analysis. We believe that it is important to understand that the approaches adopted by assets, service providers, regulatory agencies, and legislators in the digital asset industry are not the same, and a general interpretation of them is likely to lead to incorrect conclusions. Below we emphasize a few examples.

Part 2. The measures taken by the banks.

Last week, there was a report from Bloomberg stating that Kraken's retail clients can no longer rely on Signature Bank for processing their deposits and withdrawals. The report highlights that similar events are indicative of a larger trend of digital asset service providers being "de-banked".

Despite concerns over Silvergate Bank's troubles, leading digital asset companies such as LedgerX, Coinbase Prime, Galaxy, Cboe Digital, and Paxos shifted their banking partnerships, some of which moved to Signature Bank. This contradicts the notion of "de-banking" in the crypto industry, indicating that many digital asset service providers still maintain critical banking partnerships.

Part 3. The securities enforcement aspect.

Another widespread misunderstanding is about the impact of the US Securities and Exchange Commission (SEC) enforcement actions, such as civil charges and settlement against Kraken and its staking services. Following this news, observers began speculating about Coinbase and its staking services, but shortly after, Coinbase posted a blog entry clarifying its contention that staking services shouldn't be considered securities-related operations.

The application of the Howey test depends on the specific "facts and circumstances" of each case. Therefore, Coinbase's staking service may differ greatly from Kraken's in terms of product design and service delivery. Moreover, it is important to acknowledge that the Howey case is not the only precedent for determining whether an asset qualifies as a security.

The application of the Howey test depends on the specific "facts and circumstances" of each case. Therefore, Coinbase's staking service may differ greatly from Kraken's in terms of product design and service delivery. Moreover, it is important to acknowledge that the Howey case is not the only precedent for determining whether an asset qualifies as a security.

Part 4. Security classification.

In terms of asset classification, SEC Chairman Gary Gensler has recently strengthened his wording, stating that 'everything outside of Bitcoin' could be a security. While this may be the view of the Chairman or even the entire SEC, some ongoing significant legal cases may impact this view. For example, the outcomes of the Ripple lawsuit and the Wahi insider trading case could set legal precedents in the definition of securities for digital assets, which will be an important issue to watch in the future.

WEEX Blog notes: On February 24th, senior blockchain KOL Fang Jun discussed during an AMA on WEEX that there are currently two major uncertainties: 1) whether ETH will be defined as a security by the United States; 2) whether transaction activities on the Ethereum network are subject to US law. Both of these issues remain unresolved and, if taken a step further, could pose significant risks.

The correlation between cryptocurrency and stocks has decreased, but macroeconomic factors still play a significant role.

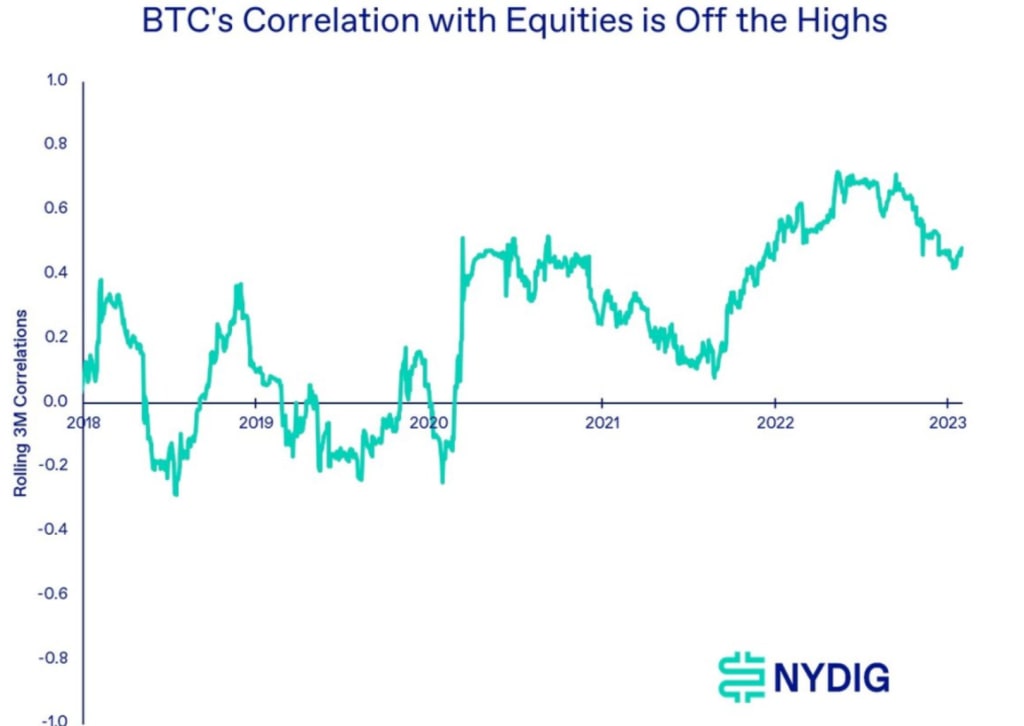

The correlation between Bitcoin and US stocks - a frequently discussed topic, has decreased from its peak in mid-2022 in recent months. We believe part of the reason for this is due to a series of catastrophic events in the crypto industry in 2022, which affected the cryptocurrency market but not other financial markets. Additionally, the recurring Bitcoin cycle appears to have regained dominance.

Even with the decreased correlation, Bitcoin is unlikely to completely escape the gravitational pull of the financial market liquidity contraction: rising interest rates. Recent economic data shows that inflation remains stubborn. Looking back at the inflationary periods of the 1970s and 1980s, it took two rounds of rate hikes before inflation eventually eased. The current inflation may require a similar round of two rate hikes. Given the direction of forward rate expectations, the market seems to be drawing a similar conclusion.

If you are keen to become a WEEX Partner, do reach out to our Head of Global Expansion at [email protected]

Connect With the Community Here:

Discord | Facebook | Twitter | Telegram

Official Website: https://weex.com/en/

Discord: https://discord.com/invite/2CFnGbMzbh

Facebook: https://www.facebook.com/Weexglobal

Twitter: https://twitter.com/WEEX_Official

Telegram: https://t.me/Weex_Global

About the Creator

WEEX Global

WEEX is one of the world's top futures exchanges in terms of trading depth, aimed at providing the most professional, secure, and private futures trading services.

Comments

There are no comments for this story

Be the first to respond and start the conversation.