How to Use Moving Average to Define an Area of Value in Trending Markets

Understanding Moving Averages

Introduction

Welcome to our comprehensive guide on how to effectively use moving averages to define areas of value in trending markets. In this article, we'll delve into the concept of using moving averages to identify potential buying or selling opportunities in trending markets. We'll cover various types of moving averages, the significance of testing, and how to time your entries for maximum effectiveness.

Understanding Moving Averages

In trending markets, a moving average can act as an essential tool to identify areas of value. A moving average smooths out price data over a specified period and presents it as a line on the chart, helping traders discern the overall direction of the trend. When combined with other technical indicators like support and resistance, moving averages can significantly enhance your decision-making process.

Choosing the Right Moving Average

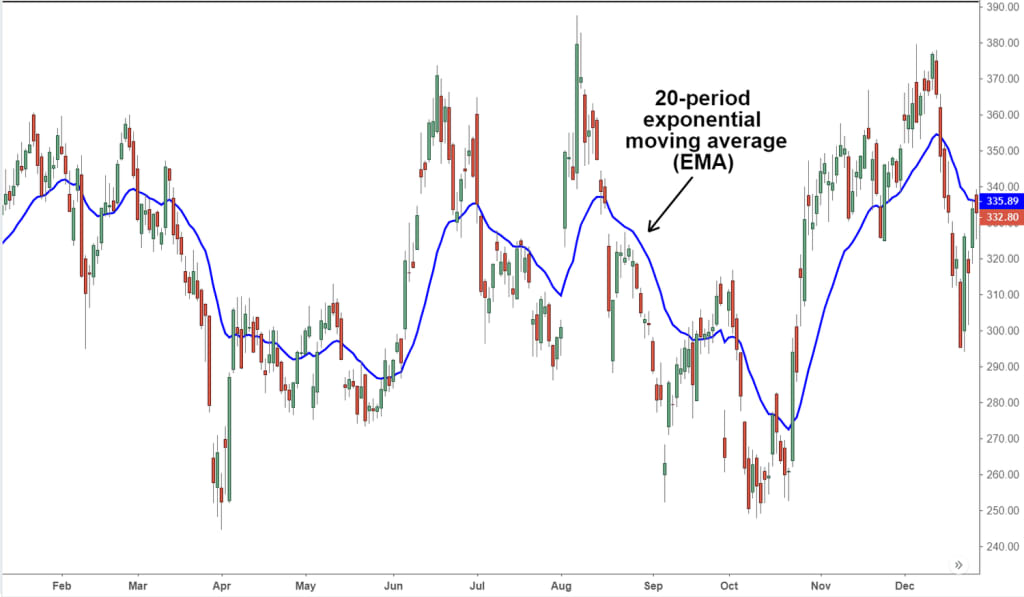

Deciding which moving average to use can be pivotal in your trading strategy. For many traders, the 50-period moving average is a popular choice. It tends to provide a clear and healthy representation of trends. However, traders have the flexibility to choose different moving averages based on their preferences and trading style. Shallower pullbacks can be identified using a 20-period moving average, while a 100-period moving average may be suitable for traders seeking deeper pullbacks.

Confirming the Moving Average as an Area of Value

Before relying on a moving average as an area of value, it's essential to ensure that the price respects it consistently. Two tests are usually required to confirm this. For example, if the market is in an uptrend and pulls back twice, testing the moving average, it signifies the potential area of value. The more times the price bounces off the moving average, the stronger the indication of an area of value.

Practical Application with Charts

Let's explore some real-world examples using charts to better understand how moving averages can be applied in different markets:

Example 1: Brent Crude Oil

In the Brent Crude Oil chart, we observe three tests where the price bounces off the 50-period moving average. This confirms that the moving average is acting as an area of value, providing opportunities for buying when the price pulls back towards it.

Example 2: USD/JPY

The USD/JPY chart shows a similar pattern with three tests, indicating the 50-period moving average as an area of value. Traders can look for buying opportunities when the price retests the moving average after a pullback.

Example 3: AUD/JPY

The AUD/JPY chart demonstrates how the 20-period moving average can serve as an area of value. Although it provides shallow pullbacks, it gives traders less time to plan their entry compared to the 50-period moving average.

Example 4: USD/CNH

In this chart, the 20-period moving average again serves as an area of value. However, the depth of the pullbacks is considerably deeper, giving traders more time to make decisions.

Recap and Entry Trigger

By understanding areas of value through moving averages, traders can make informed decisions on when and where to enter trades. The process involves first analyzing the market structure, then identifying areas of value with moving averages, and finally triggering the entry at the right moment.

Frequently Asked Questions (FAQs)

1. What is the significance of an area of value?

An area of value helps traders identify potential buying or selling opportunities on a chart. It acts as a level where the price tends to react or reverse due to market forces.

2. Can moving averages be used in conjunction with other technical indicators?

Yes, traders often use moving averages in combination with other indicators such as support and resistance to enhance their analysis and decision-making.

3. Which moving average is best for defining areas of value?

The choice of moving average depends on individual preferences and trading styles. While many traders prefer the 50-period moving average, others may opt for shallower or deeper pullbacks using different periods.

4. How many tests are required to confirm an area of value?

At least two tests are typically required to confirm an area of value. The more times the price bounces off the moving average, the stronger the indication of its significance.

5. Can moving averages be used in non-trending markets?

Moving averages are most effective in trending markets, where they help identify areas of value. In non-trending markets, other indicators may be more suitable.

6. Are there any risks associated with using moving averages?

While moving averages can provide valuable insights, they are not foolproof and should be used in conjunction with other technical and fundamental analysis.

Conclusion

In conclusion, utilizing moving averages to define areas of value in trending markets can be a game-changer for traders. By understanding market structure, selecting the appropriate moving average, and confirming the area of value through multiple tests, traders can improve their entry timing and make more informed decisions. Remember to combine moving averages with other technical indicators for a well-rounded analysis. Happy trading!

About the Creator

Jeewan Goswami

Hi Iam Jeewan Goswami

Comments

There are no comments for this story

Be the first to respond and start the conversation.