How is India proliferating its Foreign Exchange Reserve?

An achievement for New Delhi

Money is at the core of every economic activity in the world. Governments need cash to run daily activities. Authorities usually raise funds either by capital gain or revenue gains, i.e. by selling goods and services or taking out loans. Nations usually hesitate to acquire loans as countries have to pay interest etc. And only apply for the loan for a longer period. Thus, most of the Govt. Tries to use funds from revenue gains, but in the current coronavirus crisis, authorities are not having an adequate amount of reserves, thus nations are now turning their attention to their foreign exchange reserves to counter its requirement.

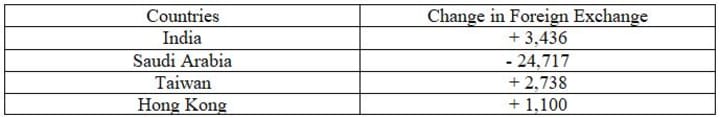

Thus, eventually, countries’ foreign exchange reserves are plummeting rapidly. The Kingdom of Saudi Arabia, Republic of China (Taiwan) and Hong Kong are examples of the few nations. Few countries are still recording a positive slope in their foreign exchange reserves. One of the countries that form that bunch is India.

- www.RBI.org

India has been registering continuous upraise in its foreign exchange reserves in the past couple of weeks. So how is a country with the world’s second-largest population not only able to sustain, but also able to jack up its reserves? Let’s figure it out.

IMF defines Forex reserves as

“External Assets that county’s monetary authority can use to meet the balance of payments financing needs.”

According to the Oxford Reference, Foreign Exchange Reserve means

“Liquid assets held by a country’s government or central bank for the purpose of intervening in the foreign exchange market. These include gold or convertible foreign currencies. They do not include working balances of foreign currencies or short-dated foreign securities held by a country’s banks or other firms. In an emergency, some of these could probably be added to a country’s foreign exchange reserves.”

Having a considerable amount of foreign reserves becomes a must in the current competitive world. Forex reserve has different uses it helps to stabilise a currency as well as significantly increase the economy’s strength and help to explode. Nation’s reputation is raised in the international market. A country’s Foreign Exchange Reserve can increase when countries expenses are slighter than their income or vice versa. India has registered a hike of $1.622 billion in its external reserves in a single week. So how is India able to minimise its expenses and amplify its income?

1. Lowering the oil import bill –

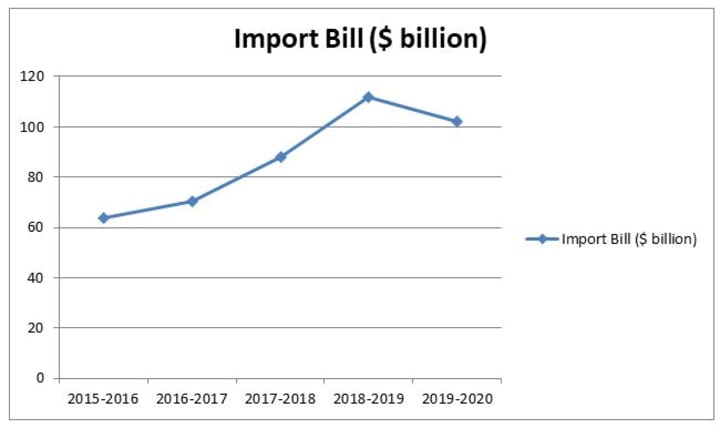

India is a power-hungry nation. It ranked 3rd globally with 5,123,000 million barrels per day (estimated) in 2018 i.e. $111.9 and now it has shrunk by 9% to $102 billion. It has saved New Delhi’s billions of dollars.

- www.economictimes.com

This pocket-size drop has also saved India at least $9 billion. Which has been deposited directly into forex reserve of the nation. Falling oil prices also help India to cut down its cost. As a matter of fact, New Delhi is capitalising on the aforementioned event by not only filling its oil reserves but also cracking a deal with the USA for lending extra oil storage.

For more insight you can read my previous blog ‘COVID-19 & decreasing oil prices’ in it I have talked in detail.

2. Upraising Pharmaceutical export –

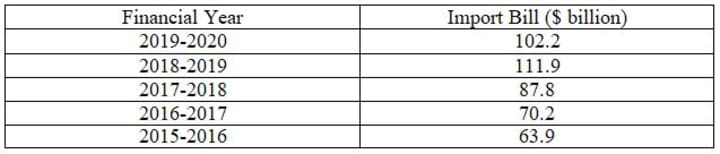

The Indian pharmaceutical industry has been on the rise since last year. It has started to capture and acquire an additional share in the international market.

- www.statista.com

(2020* - figure can raise as year progress)

Coronavirus crisis has given a positive boost to Indian firms. The most notable incident was Hydroxychloroquine. India is currently exporting it to almost 97 countries with 285 million tablets. The total figure rose from $1.22 billion to $5.50 billion in the first half of the year. The Indian pharma industry has a surly helped nation to earn more cash in times of crisis.

3. Depleting Imports –

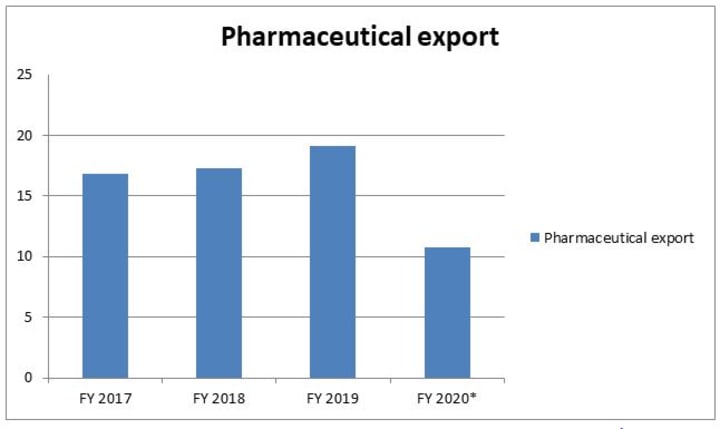

India tends to import more than it exports. For most of its history, the Indian economy is facing a trade deficit, although the trade deficit is diminishing, it is hurting the economy. In the current crisis, Indian imports have registered a nosedive.

- Ministry of Commerce and Industry, India

Indian imports have plummeted by 58.65% compared to last year. Gold imports in India slumped by 99.92%, Petroleum products imports dropped by 55.01%, Coal and briquettes plunged by 43.82%, Electronic goods by 59.06%, Iron and steel by 47.93% etc. It is recorded that India has documented an eleven-year low in April 2020. There are plenty of points which I didn't use but have had a significant impact on proliferating India's Forex reserves.

So what next?

Having a considerable external reserve doesn’t guaranty development. India has got a really nice boost and New Delhi should capitalise on that. India's external reserves are at an all-time high and it should utilise them properly. The Indian economy is contracting, many firms are facing issues and people have lost their jobs, there is an issue of migrant workers across the nation. All these problems need to solve as quickly as possible, but at least New Delhi will not face the issue of liquidity crunch. The reputation of India is much better than it used to be. India has easy access to loans etc. Which will help in the betterment of the Indians. There is still a long way to go, New Delhi has got a foundation now it all depends upon its decisions to counter the current crisis.

Conclusion –

In January 1991 India’s Forex reserve saw its lowest point of $1.2 Billion, which was sufficient to support the country for next 10 days and now India has the world’s 5th largest external reserve of $493,480 Billion. India has come a long way from 1991 to 2020, but I feel New Delhi should not stop here. India’s Foreign exchange reserve is still minuscule compared to top dogs like China etc. India should not stop here and should push its boundaries.

About the Creator

onkar jadhav

A Modern Economist.

Enjoyed the story? Support the Creator.

Subscribe for free to receive all their stories in your feed. You could also pledge your support or give them a one-off tip, letting them know you appreciate their work.

Comments

There are no comments for this story

Be the first to respond and start the conversation.