American Taxes are built for cheating

Our Taxes are UnDemocratic

The American tax system, or more specifically the United States Federal Income tax is not democratic enough. It doesn’t create an equal playing field for all Americans. By nature it is convoluted, and headed by a bureaucracy that does not hold people accountable for avoiding or cheating their taxes sufficiently. A system based in more direct democratic ideals would streamline the tax system and make it more egalitarian.

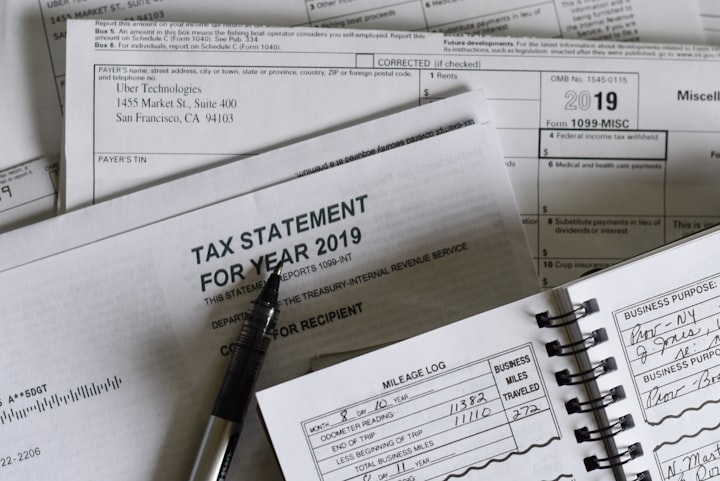

According to an IRS report “Since the beginning of 2001, there have been more than 3,250 changes to the tax code, an average of more than one a day, including more than 500 changes in 2008 alone.”(The complexity of the tax code MSP #1) With this kind of complexity how is the average American supposed to effectively participate, and properly pay their taxes. The system creates a class divide, those who understand or can pay someone to understand the complexities of income tax, and those who cannot. This is undemocratic, as those who cannot properly understand the tax system, can be unjustly paying more than is required of them, and cannot make decisions in elections that positively effect their tax situation, it has been shown that “an exclusive demos is unlikely to protect the interests of those who are excluded.”(Dahl, 129)

Meanwhile there have been many cases of people utilizing the complexity of the tax code to avoid taxation. “In theory, most individuals are supposed to pay 40% in taxes. In practice, however, the wealthy pay closer to 22% for various reasons…” (Sanghoee). Evading taxes should be regarded as an act of no civic virtue as it functions to harm the U.S. government’s ability to collect revenue.

Our current tax code and the plurality of rules and forms clashes with the idea that democracy requires homogeneity. It creates a system where people are processed differently based on their economic or career status. The idea that “a democratic polis must not be split between two cities, a city of the rich and a city of the poor,” (Dahl, 16) is central to this idea. Taxes exemplify this split between poor and rich citizens, and the different ways in which they taxation is conducted.

A more liberal argument would be that everyone has the equal opportunity to read the tax code, and attempt to avoid taxation. The more interesting argument however, would be a republican one, if it is assumed true that tax evasion is an act the reflects a lack of civic virtue, it then reflects a breakdown of the republic. An aristocratic republican view would be one that sees this system as too democratic, overcomplicated tax codes show there is nothing to “…restrain the impulses of the many…” (Dahl, 26). Meaning the people have created a tax code that is unmanageable out of impulse and greed that an aristocracy would need to correct.

The best way to correct this error is to severely simplify the tax code, remove the loopholes, make it easier for the common person to pay their taxes, and properly hold the government accountable for taxable purposes. This new tax code will tax all incomes, including capital gains, inheritance, and rental income. The guidelines for writing off income will be clear and rates will be assessed to people based on their income, increasing the rate as income goes up. There will exist only one form, corporations and businesses will use the same forms as individuals except for the fact that they will be taxed at a much higher rate. Lastly the punishments for tax evasion will be severe both financially and socially.

This proposed solution has many benefits as it creates a homogenous base for all people in the United States being taxed, to insure that all are taxed in the same way removing any room for cheating or misunderstanding. The benefits to this are very direct as it creates equality in taxes, the financial situations of people might not be equal, and the rates of taxation will not be equal, but the way the government scrutinizes all income will be equal. Understanding of the system will be more equal amongst the classes as well.

Under the current system people are forced to make their leaders tax policy trustees. The people do not have the understanding to give their leaders input on tax law. If the system were to be completely simplified the people would then have the ability not only to do their own taxes, they would also be empowered to give meaningful and forceful input to their Congressmen. Taking the power away from the Congress, and giving it to the people, as they make their Congressmen serve as delegates for their preferred policy action.

The system also streamlines the taxation process, tax forms will not only be easier to understand and prepare, taxes will be easier to process. Taking with it much of the scope of the Internal Revenue Service. The Internal Revenue Service simply by being a bureaucracy is a not a democratic institution, the IRS’s auditors are in no way elected, and are often protected through civil service laws from being removed from office. Making the system unaccountable and not sufficiently democratic.

Furthermore the proposed system of taxation would punish people who attempt to harm the U.S. government by avoiding their taxes, basically punishing those with a lack of civic virtue. Perhaps repeated offenders could even be prevented from voting or holding public office as they have proven to be corruptible. Which is an undesirable trait in democratic government.

Critics of this proposal could suggest that modern democracies do not see the value in homogeneous societies anymore, and that with the protections of minority rights the democracy can still function justly. However this proposal still has the unique ability to reduce factional conflict between the upper and lower class, and even though a democracy can withstand factions, doesn’t mean it should encourage them.

The idea that Congressional leaders would take on a role as delegates rather than trustees might not sit well with some. Those who support ideals of guardianship, believing that the minority should rule based on their superior ability (Dahl, 53), will dislike the idea that government funding will be closer to the hands of the people. However that is simply an undemocratic stance, and the notion that most members of the U.S. Congress are currently tax experts is absurd. Additionally anyone who would argue that the people would take this power and over tax the rich and under tax the rest of America has a valid fear, however the American voter has always had that power, even in a complicated tax system abolishing tax isn’t difficult if a majority wants it. It has never happened though, and it could be argued that the proposed system could generate a new understanding and respect for taxes that would produce the opposite effect.

Other critics would suggest that increasing the punishment for tax evasion is not a democratic approach. In extremes it could be suggested that an offender was trying to protect their right to property, and that in a liberal democracy that right to property must be respected. However that seems a highly unlikely argument. The right of government to tax is pretty well founded. Giving them the full right to punish members of society who withhold their share of the tax revenue.

The last issue that is foreseeable is that of consent. Critics could ask how do the people consent to be taxed in this manner? The people would consent in the very same way that the consent to be taxed now, through tacit consent. Contrarily this new system of taxation gives the people more power at the ballot boxes to hold their leaders accountable.

Through arduous legal language and sheer volume of policy a systemic block to democracy has formed within our taxation deliberations. The people are shut out and it is not democratic enough. The elite are benefiting from the complication at the cost of the average American. If something is not done to simplify or the tax system the people will continue to have little control over the system, making it not democratic enough in policy, and in the distribution of benefits.

This work was originally turned in to CSULB in Spring of 2016.

Works Cited

Dahl, Robert Alan A. Democracy and Its Critics. 15th ed. New Haven, CT: Yale University Press, 1991. Print.

Sanghoee, Sanjay. “How to make America’s tax system fair for all.” Finance. Fortune, 12 Jan. 2015. Web. 3 May 2016.

“The complexity of the tax code MSP #1 the complexity of the tax code definition of problem analysis of problem.” 2009. Web. 3 May 2016.

Comments

There are no comments for this story

Be the first to respond and start the conversation.