How do millionaires differ from the rest of us in these 17 ways?

Acting as a millionaire don't make you a millionaire

To become a two-comma millionaire, you have to do things differently than everyone else.

It has been noted that many billionaires who have built their fortunes on their own tend to follow unique routines or have heightened qualities. Rich people, for example, tend to spend more time working, learning, and investing in themselves rather than resting.

Similar wealth-building tactics, such as saving as much as possible and creating several sources of income, are also common. Millionaires, on the other hand, prefer low-cost index funds and real estate when it comes to investing. Also, millionaires tend to be frugal, conscientious, and resilient — all characteristics that enhance their wealth-building efforts.

Non-millionaires may display some of the same traits as those who are millionaires, but they tend to do so more frequently and with greater intensity.

Millionaires are distinguished from the rest of us by the following traits in addition to an estimated net worth in the range of $7-$9 million.

1. They’re thrifty.

According to Sarah Stanley Fallaw, director of research at the Affluent Market Institute and author of “The Next Millionaire Next Door: Enduring Strategies for Building Wealth,” who interviewed more than 600 American millionaires for the book, frugality is one of the wealth factors that help millionaires build wealth.

Many of the billionaires questioned by Stanley Fallaw emphasized the sense of independence they had as a result of living on a budget.

Squandering money through overspending, overspending instead of investing for retirement, and spending in expectation of getting affluent all lead to financial dependency, even if you’re making a lot of money.

2. Their housing costs are kept at a reasonable level.

According to Stanley Fallaw, millionaires like to live in areas they can readily afford, which is an excellent illustration of frugality.

A majority of the billionaires she interviewed stated they had never spent more than three times their yearly salary on a property. According to her most recent research, the typical house worth of millionaires was $850,000, with an original purchase price of $465,000.

3. They put away a large portion of their earnings.

Millionaires can save because they are frugal and have a low cost of living. They understand that money alone isn’t enough; they must put some of it away for the future.

Since retiring at 52 with a $3 million fortune from running the personal finance blog ESI Money, John has interviewed 100 billionaires and found that they save 64% of their income while spending $90,000 a year. He said that if you save it, you can use the money to make investments.

The major message, according to him, is that millionaires “save a big amount of their income,” even if the savings rate is slightly incorrect due to factors like not including taxes as spending.

Making $250,000 and spending $250,000 leaves you “no better off at the end of the year,” according to his analysis.

4. They don’t plan.

Millionaires, on the other hand, may manage their finances without the use of a budget. John found that many of the millionaires he talked to didn’t even have a spending plan.

The reasons millionaires don’t require a budget, he said on his blog, “make sense — they produce a lot and have self-control. To put it another way, they make a lot of money, but only spend a little amount of it. Who cares about a spending plan?”

If you can increase your income and learn self-discipline to avoid overspending in the later stages of a financial plan, a budget is no longer necessary.

5. They start their own business.

According to Stanley Fallaw, many millionaires prefer moonlighting or taking on a side hustle because it’s an excellent way to explore choices while still working a full-time job.

When it comes to becoming a billionaire, “those who can develop many possibilities to earn revenue, who can adapt hobbies into income-producing activities, will be successful in the future,” she said.

Many millionaires have many sources of income that allow them to expand their wealth at an exponential rate, John discovered.

6. They are real estate investors.

Investing in real estate is a common side hustle for those who have amassed a substantial fortune, according to John.

He concluded that investing in real estate “seems to be a natural result if the fundamentals are covered and excess cash is generated.”

A real estate investor, Dana Bull, says that the financial benefits of real estate investment are numerous: positive cash flow and appreciation in terms of home values, leverage, and tax advantages.

7. They put their money into index funds with modest fees.

Investing in low-cost index funds, according to John, is a common approach among millionaires as well.

Many billionaires’ wealth is built on the strong returns and low costs of stock index funds (I like Vanguard as do many millionaires),” he stated.

One reason index funds are considered a winning approach in the stock market is that they are inexpensive and well-diversified, avoiding the danger of investing in a few specific stocks. This approach has the support of even Warren Buffett.

8. They devote more time to research and preparing for investments.

Millionaires’ investment preferences may be influenced by their studies. According to Stanley Fallaw, millionaires spend an average of 10.5 hours a month preparing for investments.

Spend approximately two hours more per month on wealth accumulation than those with a net worth less than half their predicted net worth based on age and earnings, who spend 8.7 hours per month on the task.

According to Stanley Fallaw, “their financial awareness makes them more tolerant of accepting investment-related risks.”

It’s common for people to take bigger financial risks if they have a positive outlook on the future as well as a thorough understanding of the financial markets.

9. They devote more time and effort to activities that promote personal development.

In addition, millionaires devote more of their free time to self-improvement. According to Stanley Fallaw’s research, the average American only spends two hours and two-and-a-half hours each week reading for pleasure and working out.

According to Stanley Fallaw, successful people are conscious of how they use their resources, including their emotional and cognitive ones.

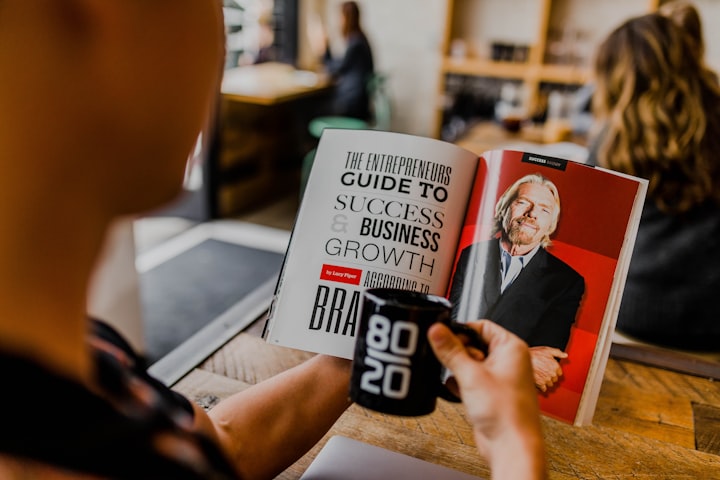

While Thomas C. Corley spent five years examining the daily routines of 177 self-made billionaires, his book “Change Your Habits, Change Your Life” revealed that they all spent at least 30 minutes each day exercising and reading.

Millionaires, according to him, are drawn to reading biographies of famous individuals, self-help books, and historical accounts.

10. They don’t get as much sleep and put in more hours at the office.

To get the most out of their limited time, millionaires, however, must make certain compromises. According to Stanley Fallaw, they sleep about eight hours less per week and work six hours more per week than the average American.

In Corley’s study, he found that many people wake up at least three hours before their workday begins as a way to deal with the unavoidable everyday interruptions that occur.

“Regaining control of your life means getting up at five in the morning and tackling the top three tasks on your to-do list for the day,” Corley wrote. You gain a sense of self-assurance that you are in charge of your destiny.

11. As a result, they’re able to come up with better ideas.

Moreover, self-made millionaires, according to Corley, are analytical thinkers. He added that the rich tend to think in private, in the mornings, and for at least 15 minutes every day.

Their success is based on their ability to think creatively, he stated. “They spent a significant amount of time each day pondering a wide range of topics.”

“What can I do to earn more money?” was one of the things they asked, according to him. “Does my job provide me joy?” “Is it?” “Do I get enough exercise?” additional charitable organizations to volunteer with?”

12. They don’t go along with the flow of things.

Millionaires, according to Corley, don’t follow the herd.

To fit in, “we will do practically anything to avoid standing out in a crowd,” Corley wrote. He remarked that most people fail to achieve success because they fail to differentiate themselves from the herd.

Successful people, he asserted, establish their flock from scratch.

By separating yourself from the herd, you can then recruit others to join you in your new herd.

13. They want to know what you think.

According to Corley, millionaires actively seek out criticism to sharpen their skills.

When it comes to getting input from others, many people are afraid of being judged. “To learn what works and what doesn’t, you need feedback. It’s easier to know if you’re on the correct track when someone gives you feedback. Good or negative, feedback criticism is essential for learning and progress.”

According to Corley, it permits millionaires to shift direction and try out a new job or business. You can’t succeed unless you have the information you need from feedback.

14. They’re tenacious and tenacious.

Self-made billionaires, according to Stanley Fallaw, rely on the qualities of early retirees and entrepreneurs to develop wealth: endurance and perseverance.

You must have a “resolution to pursue your goals through rejection and suffering,” she wrote. To acquire money and own a business, “you must have the resolve to keep pursuing your goals despite rejection and pain.”

As she said, “Millionaires and other economically successful Americans who pursue self-employment, elect to ascend the corporate ladder or strive to create a financial independence lifestyle early do so by continually pushing on.”

15. They place a high value on four of them.

Millionaires, on the other hand, aren’t able to generate riches on their own.

“Everyday Billionaires: How Ordinary People Built Extraordinary Wealth — and How You Can Too” author Chris Hogan researched 10,000 American millionaires for seven months and concluded that they attained their seven-figure status with four critical relationships: a coach, a mentor, a cheerleader, and an ally. “

In particular, Corley stressed the necessity of having a mentor.

A mentor can help you accelerate your financial success.

16. They adhere to a strict code of conduct.

According to Hogan, millionaires are self-reliant, deliberate, goal-oriented, and hard-working. The qualities he listed are shared by a wide range of people, regardless of their wealth, but millionaires, according to him, understand that they cannot function as a cohesive unit without consistency.

Taking responsibility, being purposeful, setting objectives, and working hard are all things that you are capable of, as he noted. It’s impossible to achieve your goals if you don’t keep doing the things you’ve been doing year after year, decade after decade.

People who have amassed substantial net worth throughout their lives have learned from experience that wealth accumulation takes place over a long period.

17. They’re more meticulous in their work.

According to Stanley Fallaw, the net worth of millionaires is closely linked to their conscientiousness.

It is important to understand why frugality, planning, and responsibility all play a role in wealth creation and maintenance, regardless of one’s age or income level. “Many of the behavioral components that impact net worth, regardless of how old we are or our income levels, such as frugality, planning, and responsibility, tie into this personality characteristic,” she wrote.

Similarly, Jude Miller Burke spent three years studying 200 self-made billionaires and discovered that they were more diligent than their less successful counterparts, showing the attribute to a higher degree.

Comments

There are no comments for this story

Be the first to respond and start the conversation.