How Debt Killed the American Dream

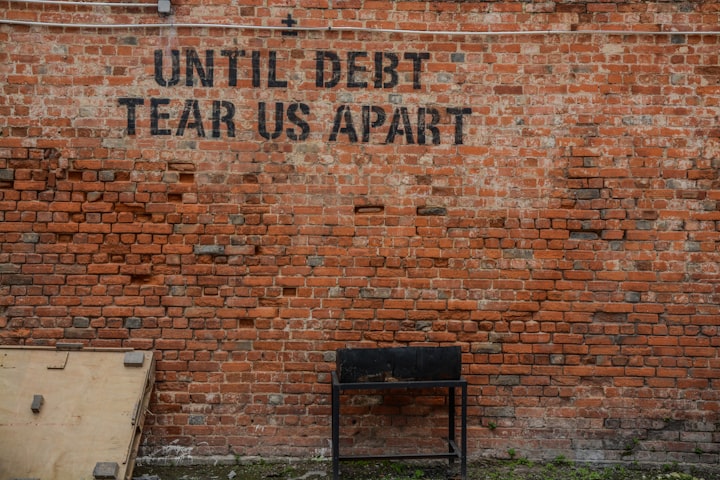

Let’s face it — the American Dream is dead.

You did everything right. You went to a good school. You moved to the city looking for opportunities. You worked long hours. You juggled multiple jobs. More than two-thirds of your income goes toward your rent and the bills are coming due. After everything’s settled up, you have almost nothing left.

Almost nothing. Most of us have less than nothing — we’ve got debt.

For many of us, the pursuit of higher education, a successful career, and home ownership is overshadowed by the harsh reality of crippling student loans, astronomical living costs, and predatory lending practices. Despite how widespread the problem is, most of us would rather swallow glass than be honest about our financial woes.

This creates a culture of silence around something sinister: the emergence of debt slavery in America. But today, we’re talking about it.

Debt Slavery — A Brief History and Present-Day Reality

Debt slavery has been a part of human history for thousands of years. In ancient civilizations, those who could not repay their debts were often forced into servitude, working for their creditors until their obligations were met (Graeber, 2011). Fast forward to the present day, and we find ourselves in a world where debt is normalized and even encouraged. For many Americans, living with some form of debt is simply a fact of life.

In the United States, student loan debt has skyrocketed in recent decades, with graduates often burdened with tens or even hundreds of thousands of dollars in loans (Federal Reserve, 2021).

Add in credit card debt, mortgages, and other forms of personal loans, and it’s clear that the modern-day version of debt slavery has taken root in our society.

The Stigma Surrounding Debt — A Barrier to Change

Despite its prevalence, debt remains a taboo subject for many. There’s a pervasive belief that those who find themselves in debt are financially irresponsible or have made poor life choices. This stigma can lead to feelings of shame, isolation, and a reluctance to seek help or support.

However, it’s essential to recognize that debt slavery is not solely the result of individual actions. Systemic issues, such as income inequality, predatory lending practices, and the ever-rising costs of education and living, have contributed to the current crisis.

Solutions to Address Debt Slavery

To tackle the issue of debt slavery, we need to implement solutions on both individual and systemic levels. Here are some potential strategies:

- Income-based repayment options: Expand income-based repayment options for student loans, ensuring that monthly payments are manageable and based on a borrower’s income.

- Consumer protection laws: Strengthen consumer protection laws to prevent unfair lending practices and provide resources for individuals to understand and manage their debt effectively.

- Financial wellness programs: Encourage employers to offer financial wellness programs and student loan repayment assistance as part of their employee benefits packages.

- Address income inequality: Advocate for a higher minimum wage and policies that address income inequality, ensuring that all individuals can earn a living wage and afford their basic needs without relying on debt.

The Importance of Financial Literacy

One of the most powerful tools we have to combat debt slavery is education. Financial literacy is often overlooked in our education system, leaving many ill-equipped to navigate the complexities of personal finance. By investing in financial education, we can empower individuals to make informed decisions about their finances and avoid the pitfalls of debt.

Here are some steps we can take to promote financial literacy:

- Integrate financial education into school curricula: Teach students the basics of budgeting, saving, investing, and responsible borrowing from a young age. This foundation can help them make more informed financial decisions throughout their lives.

- Offer community-based financial education programs: Provide accessible and affordable financial education resources for adults, including workshops, seminars, and online courses. These resources can help individuals develop the skills and knowledge necessary to manage their finances effectively.

- Promote financial wellness in the workplace: Encourage employers to offer financial education programs and resources to their employees. This support can help workers build a strong financial foundation and make more informed decisions about their finances.

The Power of Collective Action

Breaking free from the chains of debt slavery requires not only individual action but also a collective effort to address the systemic issues at play. By working together, we can advocate for policies and practices that promote financial well-being and a more equitable society.

Here are some ways you can get involved:

- Support organizations that promote financial literacy and consumer protection: Donate to or volunteer with organizations that work to educate consumers and advocate for fair lending practices.

- Join advocacy groups: Connect with local and national groups that focus on addressing income inequality, affordable housing, and accessible education. These organizations can help amplify your voice and create meaningful change.

- Vote for candidates who prioritize financial equity: Engage in the political process by voting for candidates who support policies that promote financial well-being and address the root causes of debt slavery.

Your Voice Matters — Share Your Experiences and Ideas

We can learn so much from one another’s experiences, and your stories can help illuminate the path forward. Share your thoughts, experiences, and ideas for change in the comments below. Together, we can create a better understanding of the problem and foster a supportive community working towards meaningful change.

We can learn so much from one another’s experiences, and your stories can help illuminate the path forward. Share your thoughts, experiences, and ideas for change in the comments below.

References

Federal Reserve. (2021). Consumer Credit — G.19. Retrieved from https://www.federalreserve.gov/releases/g19/current/

Graeber, D. (2011). Debt: The First 5,000 Years. Melville House.

Comments

There are no comments for this story

Be the first to respond and start the conversation.