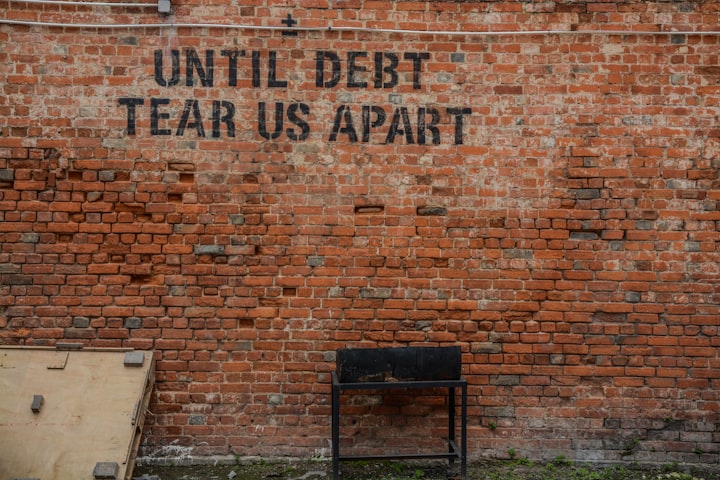

Until Debt Tear Us Apart - the Student Loan Crisis

Toss your mortarboard hat high

The only way I will get out of being held accountable for my student loans is through death.

Biden’s $10,000 and maybe $20,000 Federal student loan reduction plan helped my daughter. She owed $6,000 and if her disability discharge didn’t kick in Biden did.

But, the discharge didn’t help me.

I owed $80,000 and with the plan now it’s $70,000. Within a short period the interest will add up again and I will be back where I started — hopelessly screwed.

It’s too late for me.

During the Great Recession, I fell for the much-hyped idea to upgrade myself with more education, and College diploma in hand, the job market would magically see me as more employable.

That might be true for a graduating 21-year old not a 40 year old.

So, with promises of an educated enhanced new me the world would apparently be my oyster.

It didn’t happen.

Having a B.A. and Master’s degree later in life impressed no one. It should be listed under personal accomplishment not a door opener. Bottom line I never should have received the money which indebted me for life.

It wasn’t so much I was being delusional about my career goals it was Human Resources faced with a pile of 20-something year-olds resumes opted for youth versus experience.

The schools were happy to take my money though. Upon graduating the employment counselor looked terrified when she met me. “You’re supposed to have a network,” she exclaimed.

And so the long sad story of my student loan begins.

I was employed for 8 years in a high-paying executive job until the company went bankrupt. I never recovered financially. I lost everything and wrote about it in “Crazy in a Sick Society."

While I was employed I paid the hefty $700 per month payment. And since the interest kept building the loans doubled what I borrowed.

I wasn’t a dead beat. I tried to pay.

Currently living on Social Security, I will engrave the debt on my tombstone: Here lies an American who believed in the American Dream and lived half his life in an existential debtor’s prison.

Before I tried the college route I borrowed the money to attend two Vocational Tech schools. Both promised guaranteed job placement and both were sued for lying.

Whose idea was it to create a Federal student loan?

The history of the student loan is long dating to 1840. It was formalized into law by President Bush in 1992.

The Federal Direct Loan Program has accumulated a large outstanding loan portfolio of about $1.5 trillion and this number will continue to rise along with the percentage of defaults. — WIKI

What started as a grand idea to make post-education available to low and middle-class Americans turned into a disaster and struggle for many.

Graduates never found a job that paid enough to cover the loan payment and the cost of living.

In debt forever

Trying to discharge the Federal insured student loan debt in bankruptcy court is usually impossible. Unlike any other debt like a car, mortgage, medical, and credit card can be written off in bankruptcy. But our fair Government will not allow the same rights as other creditors.

Instead bill collectors will hound you for life to garnish payment by whatever earnings you have including Social Security.

Never mind the following had their student loans forgiven: Tom Brady $1 million, Khloe Kardashian $1.25 million, PDiddy $2 million, Reese Witherspoon $1 million, and Jay-Z and Jared Kushner (billionaires) $2 million each.

College is not for everyone

Unless your parents, scholarships, or other means are paying the tuition and the education is a sure-fire employment win don’t incur the debt.

In the 70s a 4-year Liberal Arts degree was enough to satisfy the high water weed out process in which employers subjected applicants to their prejudiced hiring practices.

In many cases, a College degree isn’t necessary to do the job.

Today a Liberal Arts degree isn’t worth the paper its printed on. And education loses value over time.

The truth hurts but immigrants attending the Ivy League with big money can realize the American Dream far more than a person born in America.

A botched system

The Government should not be in the student loan business.

The U.S. government underestimated the cost of the student loan program by billions.

The Government thought by investing in its citizens’ education would be a payback long-term but it didn’t work out.

They charge interest on the debt as private creditors do. Trying to make money off citizens should be illegal.

Does the Government make money on student loans? The answer depends on political and accounting perspectives. Since the pandemic payment pause they’re in a deep hole.

The whole student loan debt program should be eliminated. Paying to administer uncollectable debt is bad business. Ask any bank.

40% of student loan debt is unrecoverable so stop spending our money trying to service it.

Other countries like Germany and France figured out that it was best to fund higher education. But getting into the schools isn’t easy. The student needs to have a substantial G.P.A. and preparatory skills to get in.

American schools made it too easy for me to get the money.

Find another way

Indicating my intelligence level I have many letters next to my name. Welcome to my expensive vanity trip and the guilt and anxiety that comes with it because I wanted a better future.

In exchange for the status, I sign an annual student loan forbearance contract for life so I can pay the rent.

I can borrow more student loan money to pursue more education. While I’m a student the current debt is frozen. The kicker is I know I won’t live long enough to pay it back!

I feel bad for you — the taxpayer. You are strapped paying for the mistakes of a badly managed Government and a poorly thought education system.

Hopefully, you or your kids will fare better than I did.

About the Creator

Arlo Hennings

Author 2 non-fiction books, music publisher, expat, father, cultural ambassador, PhD, MFA (Creative Writing), B.A.

Comments

There are no comments for this story

Be the first to respond and start the conversation.