TDS Section 194Q-TDS on Purchase of Goods w.e.f 01.07.2021

TDS Section on Purchase of Goods-TDS U/S 194Q

TDS Section on Purchase of Goods-TDS U/S 194Q

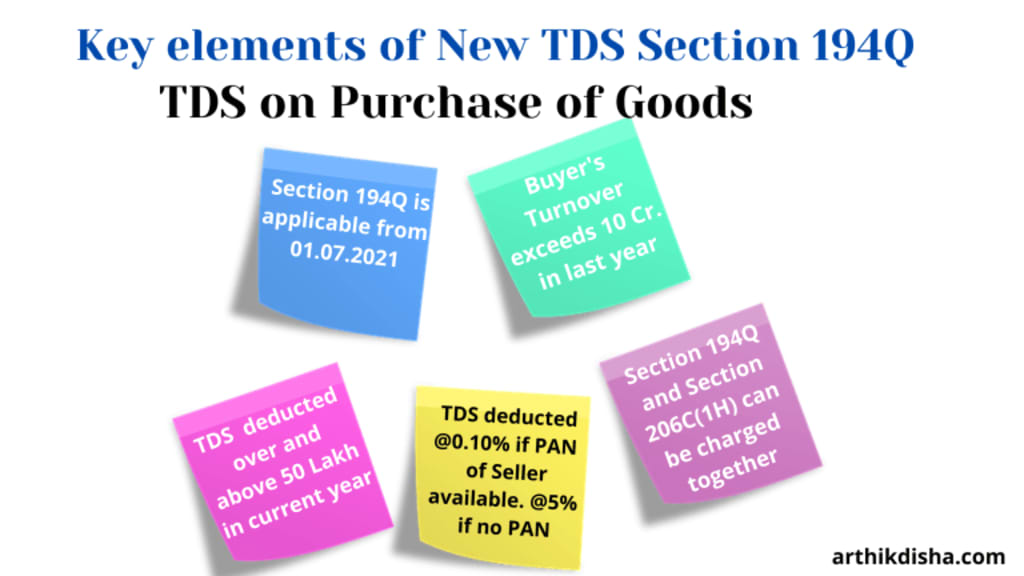

TDS Section 194Q: In the Finance Budget 2021, the Finance Minister has announced to introduce a new TDS section 194Q i.e. TDS on purchase of Goods which is applicable from 1st July 2021.

The idea behind the introduction of this TDS Section 194Q was to increase in the collection of advance income tax similar to Section 206C(1H).

TDS on Purchase of Goods-TDS deduction Section 194Q

The provisions of Section 194Q on Deduction of Tax at source on payment of a certain sum for the purchase of goods states that–

Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding ₹50 Lakhs(Fifty lakh rupees) in any financial year,

shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1% of such sum exceeding ₹50 Lakhs as income-tax.

Explanation of the provisions of TDS Section 194Q

The provisions of Section 194Q are given in simple terms as follows:

- Buyer means: For the purpose of this Section 194Q, ‘Buyer‘ means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ₹10 Crore during the financial year immediately preceding the financial year in which the purchase of goods is carried out;

- TDS over and above ₹50 Lakh: TDS will be deducted on any sum paid over and above ₹50 Lakh in a financial year. This means TDS is not applicable on the whole amount rather on any sum exceeding ₹50 Lakh only in a financial year;

- Rate of TDS: TDS @0.10% will have to be deducted on any sum exceeding ₹50 Lakh only;

- If PAN not submitted: If the seller does not provide his PAN, in that case, the buyer has to deduct TDS @5% as per the newly amended section 206AA of the Income Tax Act;

- When TDS to be deducted: TDS is to be deducted based on whichever is earlier as per the following:

1. Date of payment and;

2. Credit of the sum to the account of the seller.

When the provisions of TDS Section 194Q does not apply?

Exception: The provision of TDS U/S 194Q does not apply to the following conditions:

- Tax is deductible under any of the provisions of this Act; and

2. tax is collectable under the provisions of section 206C other than a transaction to which Section 206C(1H) applies.

As per Section 194Q(5), TDS will not be deducted on a transaction if it is covered u/s 206C [other than 206C(1H)].

On the other hand, Section 206C(1H) states that TCS will not be collected under this section if a transaction is covered under any other transaction like Section 194Q. So, section 194Q is a privileged section over 206C(1H).

So, in a nutshell, this should be kept in mind that the primary liability for deduction of tax lies with the Buyer only.

On any transaction where the applicability of both the section comes into play, TDS is to be deducted by the Buyer U/S 194Q and TCS will not be collected by the seller U/S 206C(1H).

What is the difference between Section 194Q and Section 206C(1H)?

The major differences between the two sections are as follows:

Section 194Q-TDS on Purchase of Goods:

- This section is for Tax Deducted at Source(TDS);

- This section is applicable to the purchase of goods;

- Tax is to be deducted by the Buyer;

- Deduction of Tax and deposition of tax is the responsibility of the Buyer;

- Threshold limit of ₹10 Crore is applicable to the Buyer;

- Buyer has to check whether the threshold limit of purchase of ₹50 Lakh has been met;

- This section is applicable from 01.07.2021;

- TDS U/S 194Q is to be deducted even though on the same transaction Section 206C(1H) is applicable;

Section 206C(1H)-TCS on Sale of Goods:

- This section is for Tax Collected at Source(TCS);

- This section is applicable to the sale of goods;

- Tax is to be collected by the Seller;

- Collection of Tax and deposition of tax is the responsibility of the Seller;

- Threshold limit of ₹10 Crore is applicable to the Seller;

- Seller has to check whether the threshold limit of sale of ₹50 Lakh has been met;

- This section was applicable from 01.10.2020;

- As per Section 206C(1H) if on any transaction TDS is deducted by a Buyer, Section 206C(1H) will not be applicable on that.

Why these two section 194Q and 206C(1H) were introduced?

The purpose of the Government mainly was to increase the collection of advanced income tax. This necessitated the Government to introduce the provision of Section 206C(1H).

But later it was seen by the Government that in most of the cases the buyer fulfilled the threshold limit of ₹50 Lakhs but the seller did not fulfil the threshold limit of ₹10 Crore.

So the objective of collecting more advanced tax wasn’t getting to its full potential. Therefore, probably in the budget 2021, the Finance minister by introducing TDS on Purchase of Goods tried to recalibrate their advance tax collection system.

Applicability of TDS Section 194Q with examples

Let us take an easy example to understand the applicability of TDS on Purchase of Goods under TDS Section 194Q.

Before going for the example, one should keep in mind the following two important aspects regarding TDS on purchase of Goods and TCS on Sale of Goods:

- Tax can be deducted and collected by both the Buyer and Seller U/S 194Q and U/S 206C(1H) respectively on the same transaction. This means these two sections may be applied togetherly;

- As per Section 206C(1H), if on any transaction TDS is deducted by a Buyer under any other Act, TCS U/S 206C(1H) will not be applicable on that same transaction.

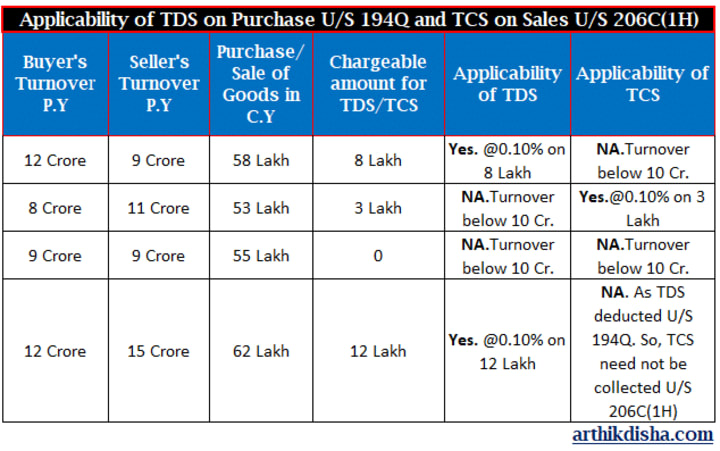

Illustration for easy understanding applicability of Section 194Q and Section 206C(1H):

The Solution to the above scenarios:

( Seller is denoted as 'S' and Buyer as 'B'. 'P'=Purchase, 'S'= Sales)

'B' (T/O) 'S' (T/O) P/S TDS TCS

12 C 9 C 58 L @ 0.10% on 8 L N/A 8 C 11 C 53 L N/A @ 0.10% on 3 L 9 C 9C 55 L N/A N/A 12C 15C 62L @ 0.10% on 12 L Both N/A

Therefore you can see from the above calculation that where TDS is applicable, TCS is not taxable. Since both the taxes are meant for collection of advance tax, two taxes can not charged simultaneously on a single transaction.

Eligibility criteria for deducting TDS on Purchase U/S 194Q:

- Buyer's turnover for the previous year must exceed Rs. 10 Crores;

- Buyer's turnover for the current year must exceed Rs. 50 Lakhs;

- TDS will be applicable on the amount of purchase exceeding Rs.50 L from a single buyer;

- TDS will be charged @0.10% on the applicable amount;

- Both TDS and TCS are not applicable to a single transaction as you can see in the 4th scenario. However, Section 194Q gets an overriding position on Section 206C(1H).

Most importantly when TDS is deducted U/S 194Q, TCS shall not be collected. But if TCS is collected U/S 206C(1H), TDS U/S 194Q may be applicable on that transaction depending upon the situation.

About the Creator

Arthik Disha

A Personal Finance Blogger. Passionate about finance.

Comments

There are no comments for this story

Be the first to respond and start the conversation.