Income Tax Calculator FY 2021-22(AY 2022-23)Excel Download

Free Excel Income Tax Calculator Download

Income Tax Calculator FY 2021-22 Excel Download(AY 2022-23)

Every year the taxpayers especially the salaried persons keep on waiting for the Finance Budget hoping that there will be some tax reliefs, additional tax deductions or an increase in income tax slabs so that their total tax outlay gets reduced.

So did they for the Finance Budget 2021, but ironically they got disappointed. This may be due to the COVID 19 pandemic situation as well.

Unfortunately, there have not been any such changes in Budget 2021 as far as the income tax slabs, income tax rates and deductions are concerned. The Govt. has been silent on the income tax matters as far as possible and practicable.

In this article, I will be discussing How to calculate Income Tax for the FY 2021-22 and AY 2022-23 using the Income Tax Calculator FY 2021-22 Excel Download tool.

As far as the salaried employees and the professionals are concerned, Budget 2021 has not been very much exciting apart from getting the additional housing loan interest benefit under the affordable housing scheme for loans taken in between 01.04.2019-31.03.2020 and it has been extended up to 31st March 2022 U/S 80EEA.

Therefore, the income tax slabs, rates and other deduction benefits are almost the same for the FY 2020-21 and FY 2021-22 respectively for the old tax regime.

Further, the Finance Budget 2021 did not utter a single word i.r.o old and the new tax regime for any changes or updates whatsoever.

Therefore for the FY 2021-22, both tax regimes will be functioning parallelly. A taxpayer has the option to choose his/her preferred tax regime once a year.

Income Tax calculator FY 2021-22 Excel Free Download detailed analysis:

Before using the Income Tax Calculator FY 2021-22 Excel Free Download tool, you must know specifically which tax regime is more beneficial to you. As there have not been any major income tax-related changes in Budget 2021, therefore, it is more or less the same with the FY 2020-21.

Therefore, it is very much essential for a taxpayer to know the basic differences between the old vs new tax regimes.

The basic differences between the two existing tax regimes are as follows:

Old Tax Regime:

- It encourages investment in tax saving instruments.

- Existing income tax deductions are allowable.

- Standard deductions and Professional Tax are deducted from income (Max Rs.52,400).

- Benefit of Housing Loan interest payment is allowed.

- Only 3 tax slabs such as 5%, 20% and 30% applicable.

- 5% Tax rate is basically non-functional.

- Tax rebate of ₹12500 is allowed for income up to ₹5 Lakh.

- Deductions under Chapter VIA is allowed.

- This tax regime is more beneficial for income up to ₹15 Lakh.

New Tax Regime

- It discourages investments in tax saving instruments.

- Major existing deductions are disallowed.

- No deduction is permissible for Standard Deduction & Professional Tax.

- Housing loan interest payment is disallowed.

- 6 tax slabs applicable such as 5%, 10%, 15%, 20%, 25% and 30%.

- For every ₹2.5 Lakh, the tax slab changes by 5%.

- Tax rebate of ₹12500 is allowed for income up to ₹5 Lakh.

- Deductions under Chapter VIA are not entitled to be claimed.

- This tax regime is more beneficial for income above Rs.15 Lakh.

Limitations of New Tax Regime FY 2021-22:

- As per Section 115BAC, a taxpayer choosing the new income tax regime is not eligible to claim the following income tax deductions:

- Leave travel concession U/S section 10(5);

- House rent allowance U/S section 10(13A);

- Allowance for the income of minor as contained in section 10(32);

- Standard deduction, Entertainment allowance and Professional tax as contained in U/S 16;

- Deduction on account of Interest paid U/S 24 i.r.o self-occupied or let out house property;

- Set off of carried forward losses and Depreciation are not permitted now;

- Deductions under chapter VIA such as section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA.

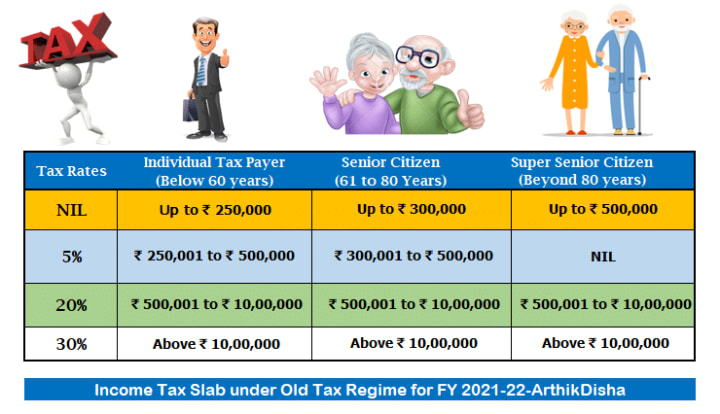

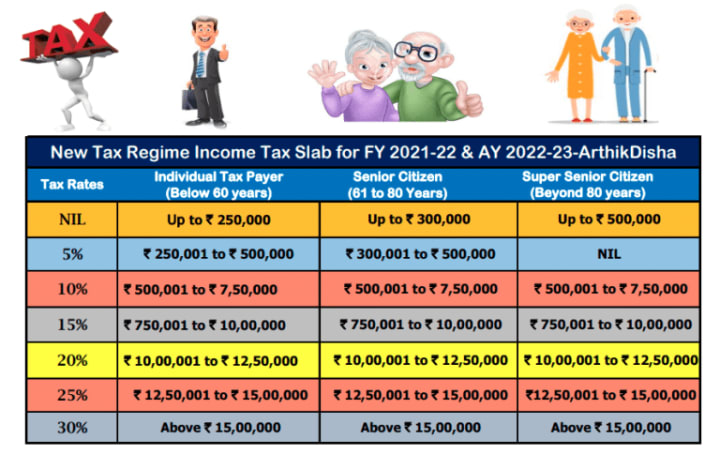

Before using the Income Tax Calculator AY 2022-23 Excel tool, let us first see the income tax slabs for the FY 2021-22 and AY 2022-23 as follows:

Old Tax Regime Income Tax Slab FY 2021-22 & AY 2022-23

New Tax Regime Income Tax Slab FY 2021-22 & AY 2022-23

Income Tax calculator FY 2021-22 Excel Free Download tool:

Income tax calculation sometimes becomes a daunting task. Also, the question arises in your mind like which tax regime to choose. So, this Income Tax calculator FY 2021-22 Excel Free Download has been designed keeping all these aspects in mind.

This excel-based calculator is a combination of both old and new tax regime. You don’t need to do anything extra. Just put all your income and deductions details and this calculator will automatically calculate your final tax liability at a glance under both regimes.

Key Features of Income Tax Calculator AY 2022-23 in Excel Old and New:

The key features of this Income Tax Calculator AY 2022-23 Excel are as follows:

- This a combined calculator for calculating your tax liabilities under both old and new tax regimes;

- It helps you in deciding which tax regime is best for you;

- This calculator shows your total tax liability as a % of the gross total income(GTI);

- This calculator is best suited for Salaried persons;

- You can not use this tool for calculating your Long Term Capital Gain Tax;

- This excel-based calculator is password protected for giving you the best results;

- Just put your details in the orange cells only, and don’t try to delete other unused cells to maintain the sanctity of the calculator;

Income Tax Calculator for Salaried Employees AY 2022-23 in Excel Old and NewBudget 2021 has been most disappointing for the salaried employees so far. Neither there has been any slab changes, nor any additional tax benefits. Only benefits for the new home buyers U/S 80EEA has been extended for one more year.

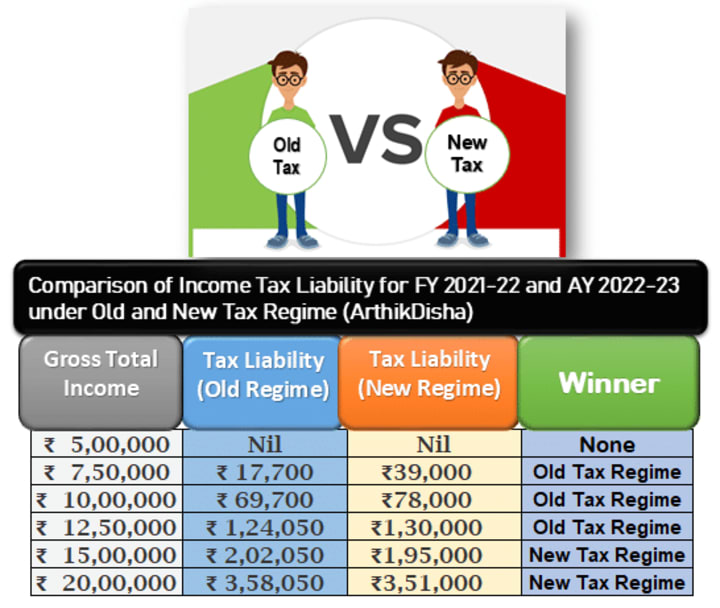

Now let us take an example for a salaried person and see how this excel based calculator depicts the results.

Example 1– Mr Sourav, age 45 years, received gross salary between ₹5 lakh to ₹20 Lakh for F.Y 2021-22. His investment in Section 80C is ₹1.5 Lakh and Mediclaim insurance U/S 80D is ₹25,000 only. Professional Tax deduction ₹2,400 per year. Compute his tax liability under both tax regimes.

Therefore it is quite evident from the above comparison that the New Tax regime is beneficial only when your total income exceeds ₹15 Lakh and you don’t have any interest repayment on housing loan U/S 24.

Which Tax Regime is best for you-Old or New?

It is seen from the above comparison table that for an annual income up to ₹15 Lakh, the Old tax regime is more beneficial considering the full 80C deductions and 80D deduction of ₹25,000.

But the scenarios get changed if Housing Loan interest is paid to the tune of ₹1 Lakh. If any HBL interest is paid, then for every income level, as shown above, the Old Tax regime will be a complete winner.

So, it can be said that interest on repayment of a Housing Loan plays a pivotal role in deciding which tax regime is best suited for you.

Therefore, if you pay any interest on your Housing Loan, it is suggested that you choose the Old tax regime, as it will ensure that your total tax outlay is reduced to some extent.

For Downloading the Excel Income Tax Calculator Check the below link

Download Here

About the Creator

Arthik Disha

A Personal Finance Blogger. Passionate about finance.

Comments

There are no comments for this story

Be the first to respond and start the conversation.