Is Possible To Be Wealthy As An Employee?

Yes, but most employees are not working smart enough to make themselves rich

When we take into account the number of hours employees put into their work, then we can comfortably say they earn peanuts, which amounts to nothing. This is because most are not earning enough for anything to invest in the long term. This is just one reason some say, employees, cannot be wealthy by working for someone else. However, entrepreneurship cannot be the only route to wealth.

We can however look at the very high corporate employees on top of the ladder who earns massive salaries. According to Financial Times Stock Exchange (FTSE) index, Pascal Soriot, Chief Executive of Astra Zeneca remains the highest-paid employee with an annual salary of $15.5m because of Astra Zeneca involvement in the COVID-19 vaccine. The CEO of Credit Rating Agency, Experian, Brian Cassin earned $10.5m in 2020.

The Salary Think Tank payscale is about £31,000 on average. It says an average employee is paid 86 times less than the chief executives, so we can imagine what we are saying here.

If we look again at business owners, their CEO earn much more than those in FTSE companies. For instance, the CEO of privately owned Bet 365, Denise Coates earned £421m in 2020. This is an eye-opener for those of us who believe we can become wealthy by gambling. Bet 365 can afford to pay this much because most gamblers are losing money. Here is a list of the highest-paid CEOs

Four Ways Employees Can Build Up Wealth

There are however some ways that employees can get rich, these are:

- Performance-related bonuses, common among salespeople.

- High salaries as indicated above, but this is common only among the top executives.

- Pensions - if an organisation has good contribution pension funds, that are invested wisely, this can add up to the wealth of their employees.

- Share of stock options - some organisations have share options for certain employees. Most have a minimum number of years in which you have to work for the company to be able to participate.

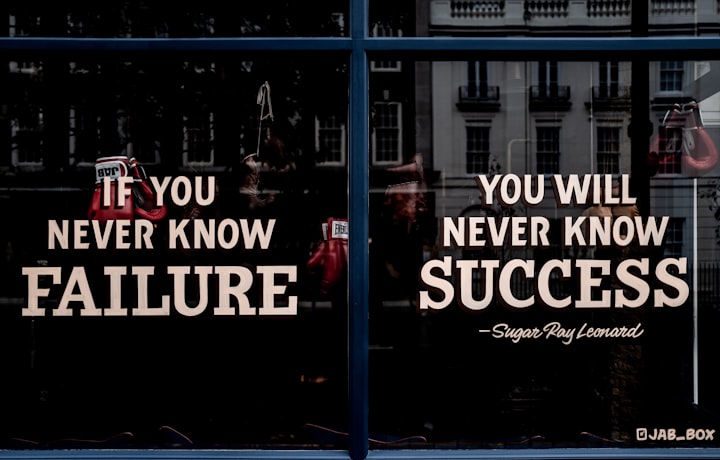

The Greatest Financial Reward Comes By Working Smart

It was Ric Elderman who said that:

‘’If all you do in life is work really hard, you’re never going to get wealthy. Because it’s not enough that you work hard to make money to set some of it aside.”

Ric was talking about investing your money to generate additional income streams. And he meant high yield proven investments. Ric says you can mitigate risks by having a mix of a portfolio of investments. Employees can get rich by owning investment assets.

‘’The rich do not depend on one single income’’ Grant Gardone

Learn how to manage your income. Again, spending less than you earn is still the greatest route to having something left over to invest. The economy is built on how much you can spend, but you have to be wise in ignoring the urge to spend your money on what you don’t actually need. Living simply is never yet to go out of style, learn the art of living simply, that is a minimalist lifestyle.

‘’Never depend on a single income. Make investment to create a second income’’ Warren Buffett

If you are working for your boss for eight hours a day, get home and work for yourself the rest of the hours. Working for yourself include assessing your future, what you can do as a side hustle alongside your work etc. Look closely at your talents and what you can do with them to attract additional income.

The preference for investment over unnecessary consumption is the key to wealth creation.

The Takeaways

Yes, you can get rich by working for someone else, all you have to do is work smarter. Working smarter involves spending less than your earn and investing the rest.

You can get rich by owning investments. Getting rich does not depend on where or how you work, but on making smart decisions with your money.

‘’Do not save what is left after spending, but rather spend what s left after saving.’’ Warren Buffett

Your investment portfolio should include mixed and diversified investment packages to mitigate loss.

Differentiate needs from wants to outsmart todays’ urge to keep buying and disposing of the older but still working gargets.

Finally, being rich is a state of the mind.

‘’Two people are richest in the world. The person who has everything he needs and the person who needs nothing other than what he has.’’ Robin Sharma

About The Author

Lanu Pitan is a Nigerian ex-pat living in the United Kingdom. She is a Chartered Accountant for many years before she retired as a Group Head Finance of a Publicly quoted Insurance Company. She now manages her own small operation.

About the Creator

Lanu Pitan

An avid reader first and foremost. A lover of Nature, as Nature is the language of God. Love is all that the law demands.

Comments

There are no comments for this story

Be the first to respond and start the conversation.